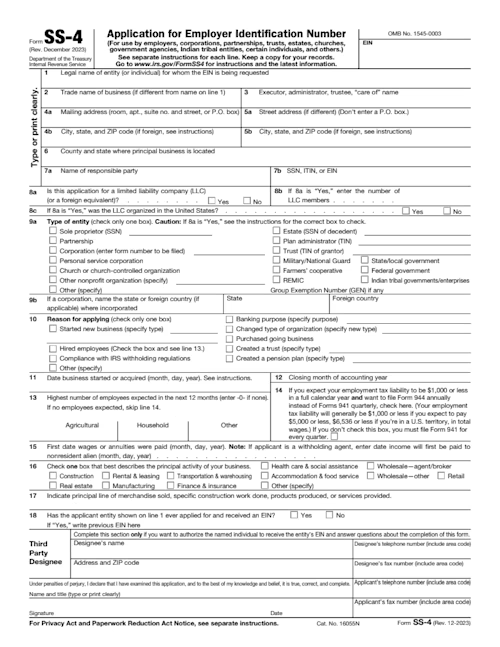

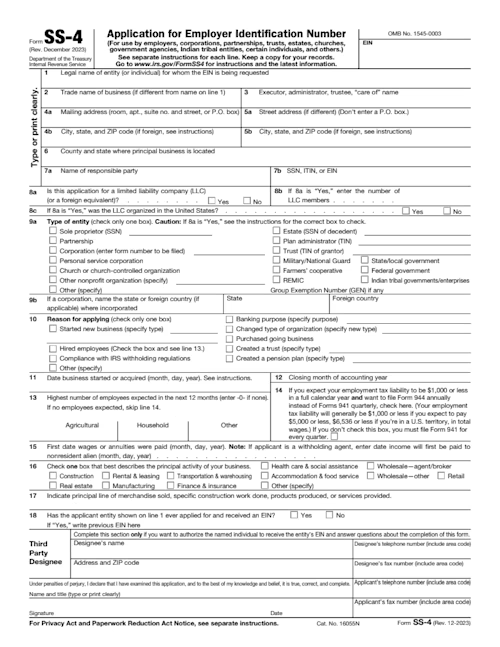

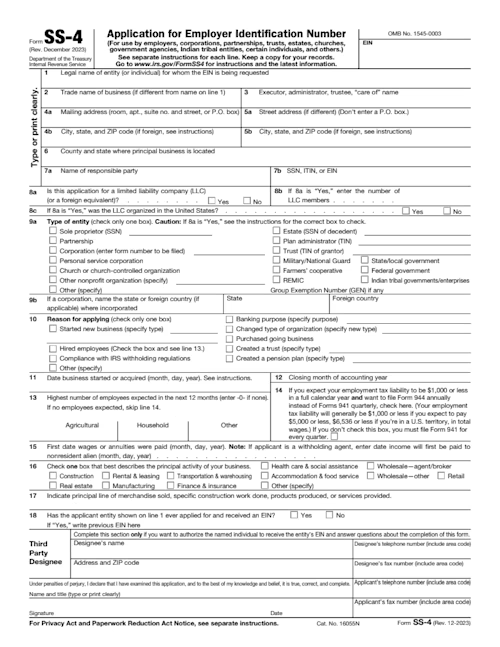

SS-4 form

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

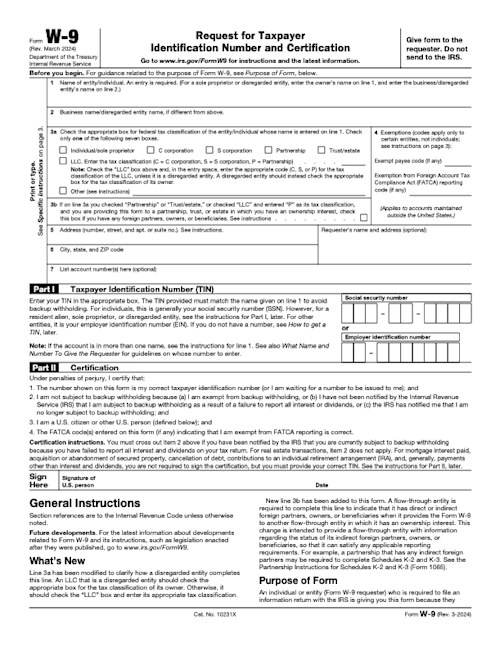

Before you pay a contractor, get a W-9. Our customizable W-9 form makes it easy to collect all the necessary information the IRS is looking for.

You will need to switch to a laptop, tablet, or desktop to use this template.

Required by the IRS for businesses working with freelancers, independent contractors, vendors or service providers, a W9 is one of the most common tax forms in the United States. Businesses often require a completed W9 before issuing payments or a 1099 at year’s end, making it essential for tax compliance.

Docusign’s standard W9 form template is easy to edit online so you can quickly provide accurate taxpayer details to the requesting business. Our fillable example includes all the standard fields for taxpayer information required by the IRS including business name, address, Social Security or Employer Identification Number, and federal tax classification in a clean, professional format.

A completed W-9 on file helps ensure accurate tax reporting, prevents payment delays, and keeps you compliant with U.S. tax regulations. You can download this blank form to fill out and send in minutes, whether you’re working with local businesses or clients nationwide. Get started today with a free Docusign account to easily create, sign, and manage your W-9 online.

Use a W-9 form template in Docusign. You can do this with your existing Docusign account or by signing up for a free trial.

Once you’ve edited the template to fit your needs, you can easily send the document via Docusign envelope to the parties who need to add information and sign the agreement. After the agreement has been signed and completed, you can find the agreement in your Docusign account.

The W-9 form is also known as a Request for Taxpayer Identification Number and Certification form. It is a type of IRS form used by businesses to collect tax information including the person’s name, address, and taxpayer identification number (TIN).

Specifically, businesses typically use the W-9 form to request tax information from temporary employees, such as contractors and freelancers. These employees are not officially listed as full-time employees by the company, but the company has paid them enough that they have to report that payment in their taxes. Full-time, official employees usually won’t need to fill out a W-9 form; they will fill out a W-4 form, or Employee’s Withholding Certificate, instead.

By filling out a W-9 tax form and submitting it to the company you’ve worked for, you are providing that company with the information they need to report how they’ve paid you on their own taxes. They will do this while filling out another tax document, such as a Form 1099.

Business owners must request W-9 forms from contractors, consultants, freelancers, and any other non-employees who received compensations totaling $600 or more during any given year. They will also need to collect a W-9 from sales professionals they’ve paid at least $5,000 within the past year.

Beyond self-employed contractors, W-9s might be required for anyone who has to report income outside the scope of a full-time job. Examples include real estate transactions, mortgage interest, stock sales, canceled debt, and any contributions made to an IRA.

Full-time contractors typically complete a W-4 Form and aren’t required to fill out a W-9.

The W-9 is needed to generate a 1099 during tax season.

The IRS provides an updated example of a W-9 tax form on its website. This pdf should be exactly what your W-9 form looks like and should include every field. Reading the most updated version of the W-9 form is also an excellent way to understand why it exists, how to fill it out, and exactly what you are certifying when you submit yours.

Step-by-step instructions on how to fill out the W-9 are included on the W-9 itself. The document is one of the more straightforward tax forms to fill out. Contractors will have to include basic information such as their name, business name (if applicable), and address on the W-9, as well as their social security number or taxpayer identification number. They’ll also need to indicate their federal tax classification, including C-corporation, S-corporation, LLC, or individual.

Certain entities have the option to submit claims for tax exemptions. Before submitting the form, it has to be signed and dated to certify its accuracy.

As of April 1998’s IRS Announcement 98-27, those who need to can fill out, sign, and submit W-9 forms electronically. The IRS allows payers to send W-9 and W-9S forms electronically as long as:

The electronic system ensures that the information received by the payer is the same information input by the form filler.

The information submitted is exactly the information that would be included in the paper form.

The form includes a W-9 electronic signature by the payee whose name is on the form.

This W-9 electronic signature identifies the payee submitting the form and authenticates the submission the same way it would identify and authenticate the signee on a paper version of the form.

The electronic W-9 Form must include a perjury statement.

The payer must be able to supply the IRS with a hard copy of the W-9 form upon request.

Electronic systems such as Docusign are designed to fulfill each of these requirements so that using them to fill out your W-9 forms is legitimate and legally enforceable.

There are several advantages to filling out W-9 forms electronically and even signing them with a W-9 electronic signature. The process:

Saves time: Using the shareable template, employees can fill out the form faster, and HR professionals can upload the templates to their systems more efficiently.

Reduces errors: Rather than task workers with complicated calculations, the pre-built Docusign template does fast math for you to eliminate errors.

Makes the signing process easier: Electronic forms also remove any confusion employees might have about what they need to fill out by tagging required fields.

Protects sensitive information: Docusign’s security measures authenticate the W-9 electronic signature while safeguarding the sensitive information the form discloses.

By digitizing the process, HR professionals can avoid the complexity of obtaining wet signatures and the tedious back-and-forth required when illegible handwriting makes vital data unreadable.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

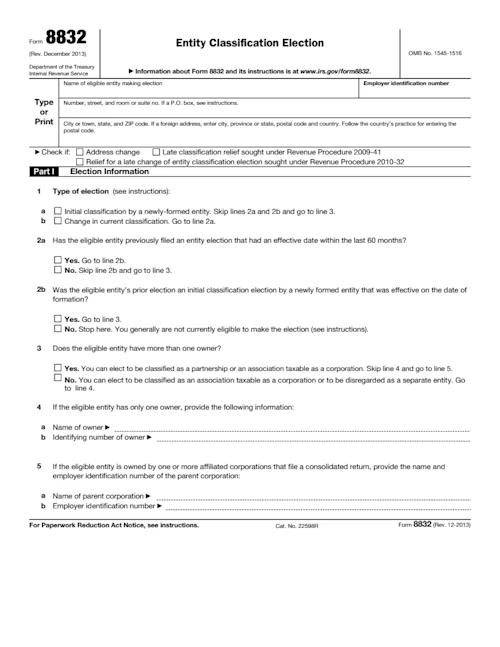

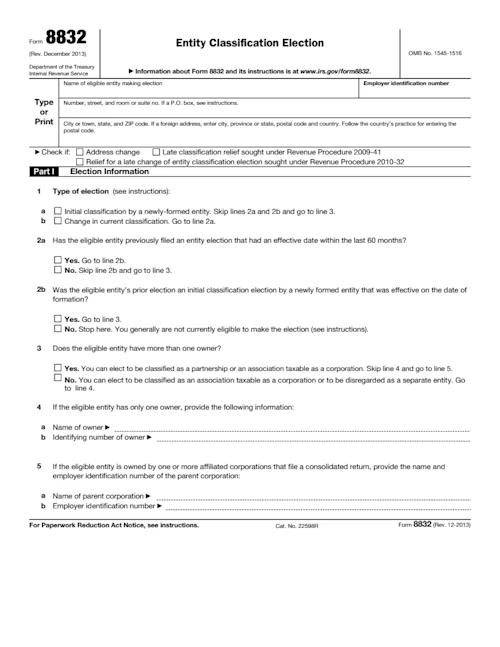

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

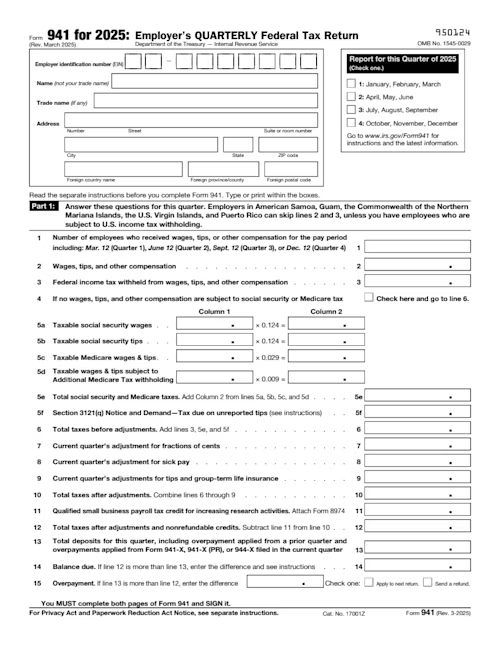

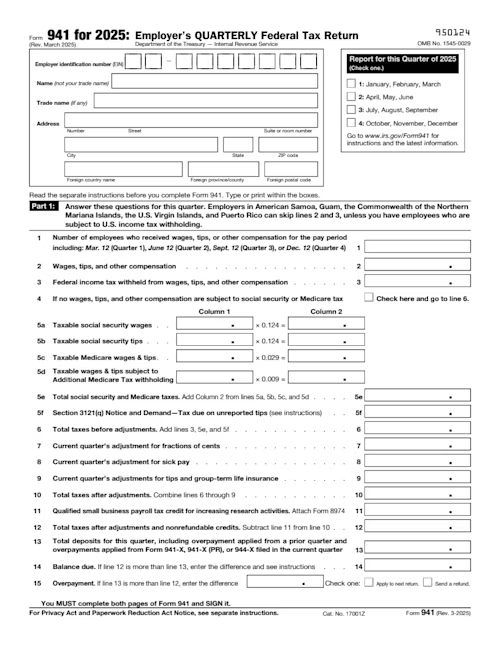

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.