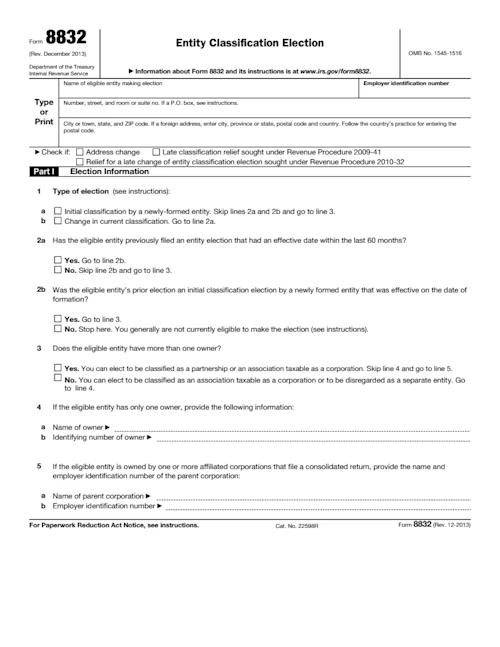

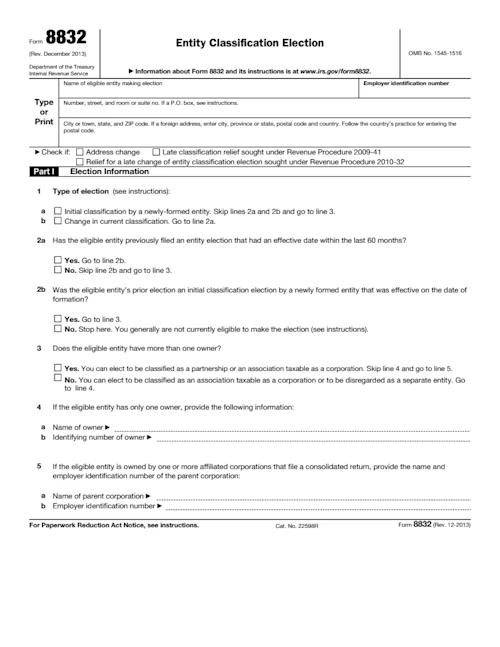

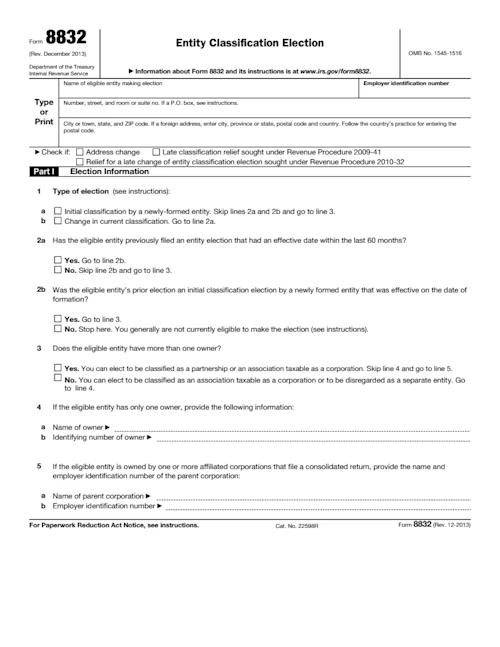

8832 form

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

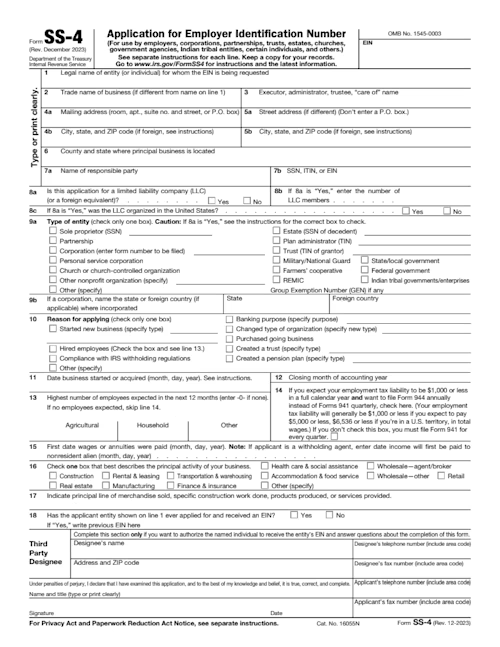

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

You will need to switch to a laptop, tablet, or desktop to use this template.

Before you can hire a team or file business taxes, you’ll need to complete the SS-4. The SS-4 form is your official application to the IRS for getting an Employer Identification Number (EIN) which is basically like a Social Security Number for your business. And that’s why it’s also called the Application for Employer Identification Number. The form gathers the basic info about your company, like its name, address, and structure. Getting an EIN is a must-do for most businesses to legally operate, and the SS-4 is the form that gets it done.

Docusign makes tackling this government form simple. Our free, fillable SS-4 template, you can quickly enter all the required information in a clean, professional format. Once you're done, you can download, print, or use Docusign to securely sign and store a copy for your records before submitting it. Ready to start, click on the sample SS-4 below:

To get your business officially on the map, applying for an EIN with the SS-4 form is a prerequisite. And with Docusign, you can easily prepare and store a secure record of your completed EIN application, ensuring your business is ready for tax season as you don’t want any misunderstandings with the IRS.

Take the first step towards official business status by getting started with a free Docusign account.

Form SS-4, also known as the Application for Employer Identification Number (EIN), is an IRS form that businesses use to apply for a unique nine-digit EIN. This number identifies a business entity for federal tax purposes, much like a Social Security number identifies an individual. Obtaining an EIN is essential for reporting taxes, opening business bank accounts, hiring employees, and conducting other official business activities.

Form SS-4 collects details about your business, including legal structure, ownership, mailing address, and the reason for requesting an EIN. Once approved, the EIN enables the IRS to track tax obligations and ensures proper reporting of income, employment taxes, and other business-related filings.

Most businesses, including corporations, partnerships, LLCs, and sole proprietors, need to file Form SS-4 to obtain an EIN. You generally need to apply for an EIN if:

You plan to hire employees

You operate as a corporation or partnership

You need to open a business bank account or apply for certain licenses

You are required to file any federal tax returns, such as employment, excise, or alcohol, tobacco, and firearms taxes

Some individuals, such as sole proprietors with no employees or certain trusts and estates, may not need an EIN. For full guidance, consult the IRS instructions for Form SS-4.

Businesses can apply for an EIN electronically through the IRS website or through authorized third-party providers. Electronic submission allows for faster processing, instant EIN assignment for most applicants, and reduced errors.

Approved systems ensure that:

All required fields are completed accurately

The responsible party is properly identified

Any required declarations are included

A confirmation of EIN assignment can be generated and stored

While Docusign can be used to collect and manage signed business authorization forms, the actual submission of Form SS-4 must be done directly through IRS-approved electronic channels.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

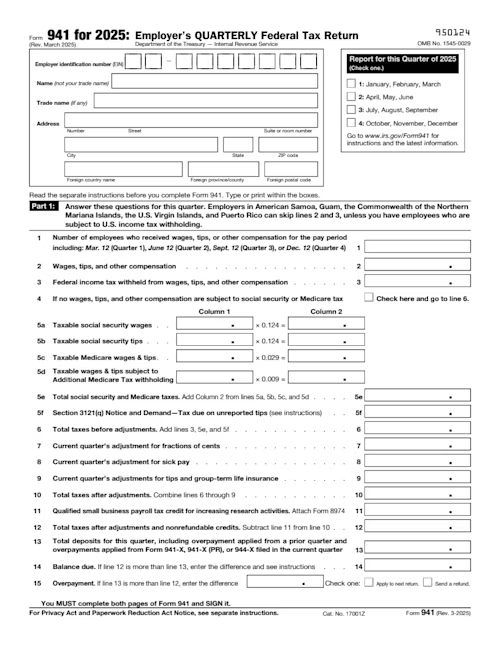

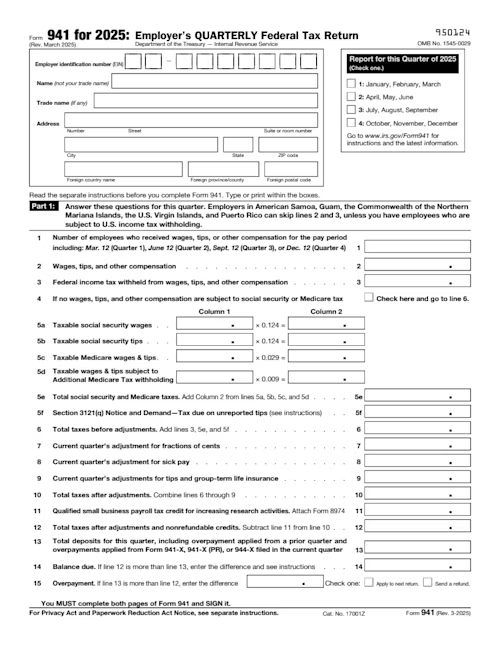

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

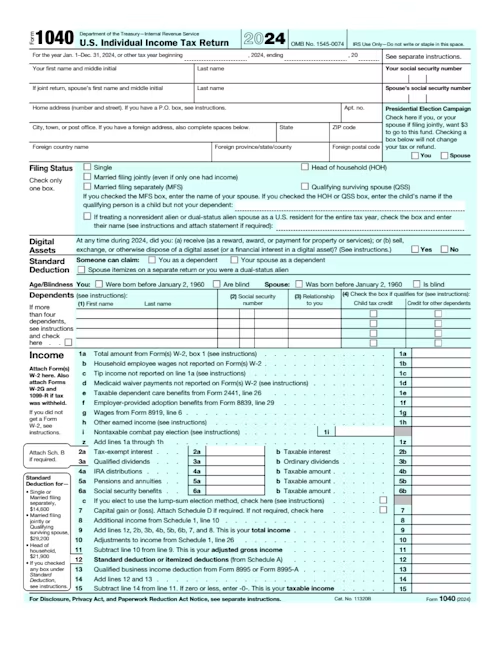

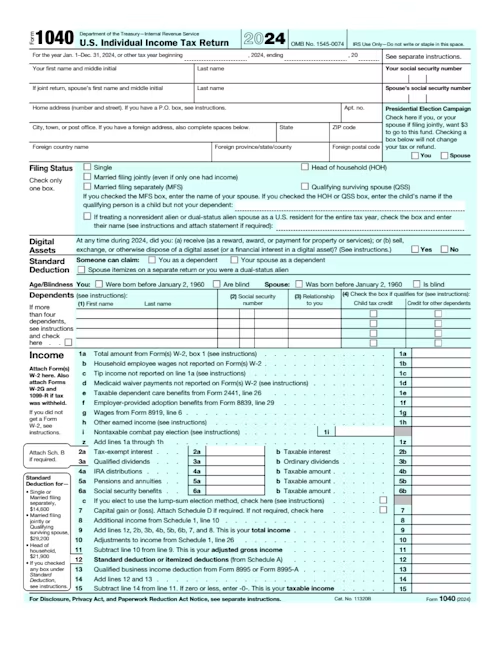

It's tax time. Use our guide and fillable 1040 form to file your annual individual federal income tax return.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

It's tax time. Use our guide and fillable 1040 form to file your annual individual federal income tax return.