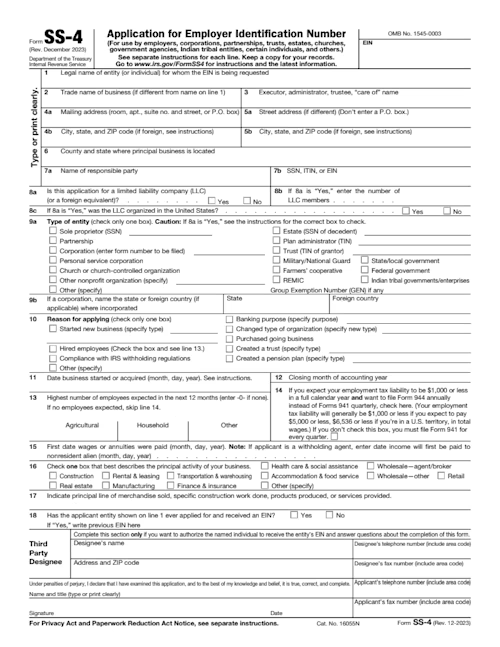

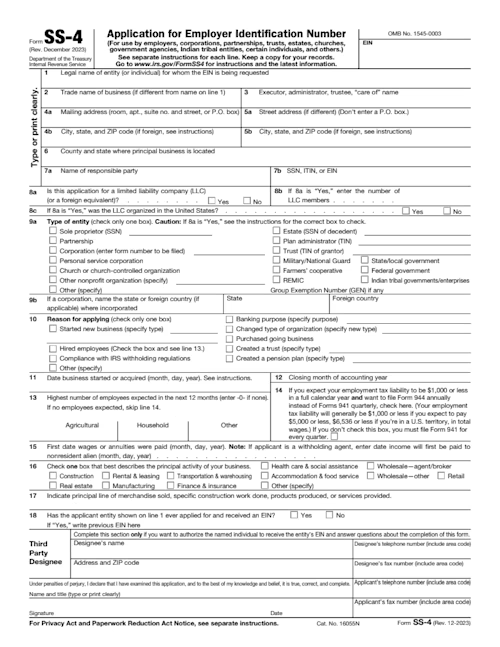

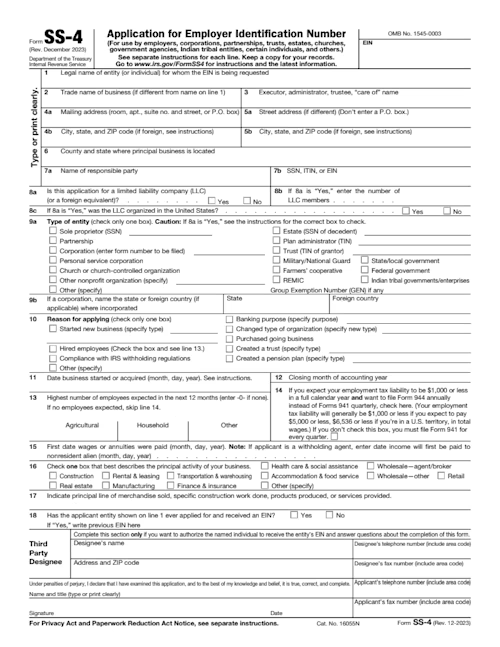

SS-4 form

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

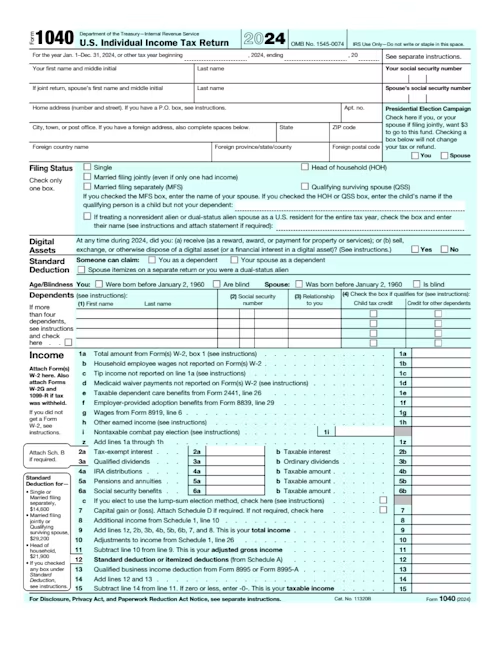

It's tax time. Use our guide and fillable 1040 form to file your annual individual federal income tax return.

You will need to switch to a laptop, tablet, or desktop to use this template.

Every U.S. taxpayer uses the 1040 to file their annual income taxes and the 1040 form is the standard IRS document used to file individual income taxes in the United States. Like the one found on IRS.gov, our free, fillable 1040 form template matches the official format and is ready to download, print, or save for your records. This example follows the official IRS layout, making it easy to fill in all the necessary sections for reporting income, deductions, and credits.

Filing a 1040 correctly ensures accurate tax reporting and helps avoid penalties. Our tax template is available online for free and can be printed. Get your free 1040 form in Docusign.

Form 1040 is the official IRS form U.S. taxpayers use to file their individual income tax returns. It’s one of the most widely used tax documents in the United States, allowing individuals to report their annual income, claim deductions and tax credits, and calculate how much they owe or how much they’ll be refunded.

While there are several variations of the 1040 (such as 1040-SR for seniors), the standard Form 1040 is used by the majority of taxpayers. It collects a wide range of information, including your income, filing status, dependents, and types of income (such as wages, self-employment income, interest, or dividends). It also accounts for any deductions, credits, or tax payments you've made throughout the year.

In short, the 1040 form is how you tell the IRS:

Here’s what I earned.

Here’s what I paid.

Here’s what I owe—or what you owe me.

If you earned income during the tax year, whether from a job, freelance work, business ownership, investments, or other sources, you’re likely required to file a 1040. In general, you must file a federal tax return if your income exceeds the IRS filing thresholds, which vary based on your filing status (e.g., single, married filing jointly, head of household) and age.

You’ll need to file a 1040 if any of the following apply:

You earned self-employment income of $400 or more

You had taxes withheld from your paycheck and want a refund

You owe alternative minimum tax (AMT)

You received certain advanced payments, like the Premium Tax Credit or the Advance Child Tax Credit

You’re claiming deductions like student loan interest, retirement contributions, or mortgage interest

Even if you’re not legally required to file, submitting a 1040 can be smart—especially if you qualify for refundable tax credits or want to receive a tax refund.

The IRS Form 1040 is a multi-page document that includes sections for:

Personal information (name, Social Security number, filing status)

Income from all sources

Adjustments to income

Standard or itemized deductions

Tax credits

Payments already made (e.g., through employer withholding or estimated payments)

Final tax owed or refund due

You can find the most recent version of Form 1040 directly on the IRS website. It's updated each year to reflect tax law changes, income thresholds, and standard deduction increases.

Filling out a 1040 can vary in complexity based on your financial situation. For simple tax returns, the process is fairly straightforward. You’ll need to:

Choose your filing status (single, married filing jointly, etc.)

List all sources of income—this can include W-2s from employers, 1099s from contract work or dividends, and more

Claim any adjustments or deductions, such as IRA contributions or student loan interest

Decide whether to take the standard deduction or itemize deductions

Calculate your total tax liability

Subtract any credits and payments already made

Determine whether you owe taxes or are due a refund

The IRS provides step-by-step instructions alongside the form, but many people use tax software or consult a tax professional to make sure everything is accurate.

You can complete and submit a 1040 electronically using approved IRS e-file providers. These systems allow you to securely prepare, sign, and transmit your tax return to the IRS, including your electronic signature, which is legally binding.

The IRS accepts electronic signatures for individual tax returns when filed through:

IRS-authorized e-file software

Tax preparers using IRS e-file services

Commercial filing platforms that comply with IRS security and signature verification requirements

These platforms ensure:

The return is accurate and matches the structure of the paper form

The electronic signature is linked to the person filing

The form includes all necessary declarations (such as perjury statements)

A signed copy can be reproduced if needed

Docusign can be used to collect and store signed tax documents (like Form 8879, which authorizes an e-file) from clients or team members if you're a tax preparer—but the actual submission of the 1040 to the IRS must happen through an e-file system.

Filing your Form 1040 electronically has several benefits:

Faster processing: Electronic returns are usually processed in under 21 days, while paper returns can take much longer.

Fewer errors: Tax software checks for basic mistakes and performs calculations automatically.

Quicker refunds: Choose direct deposit and get your refund faster.

Secure transmission: IRS e-file systems encrypt your data to protect your personal and financial information.

For individuals or tax professionals looking to streamline the process and minimize paperwork, digital tax tools—including secure e-signature solutions—help reduce complexity while staying compliant.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

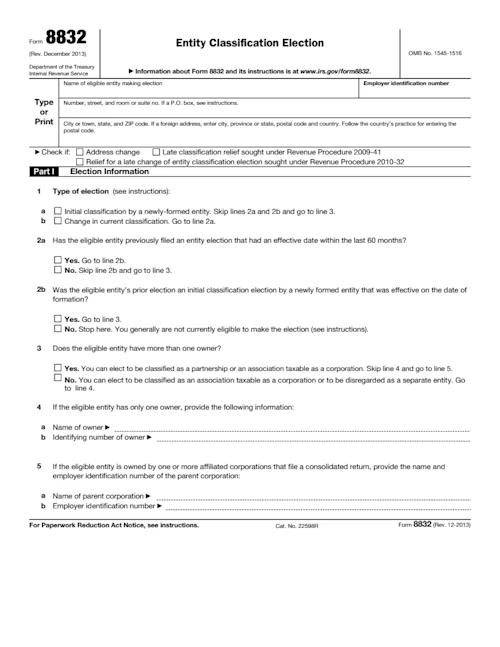

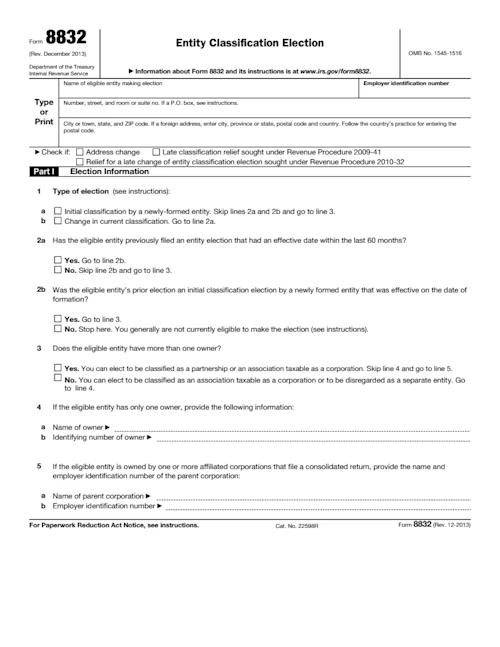

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

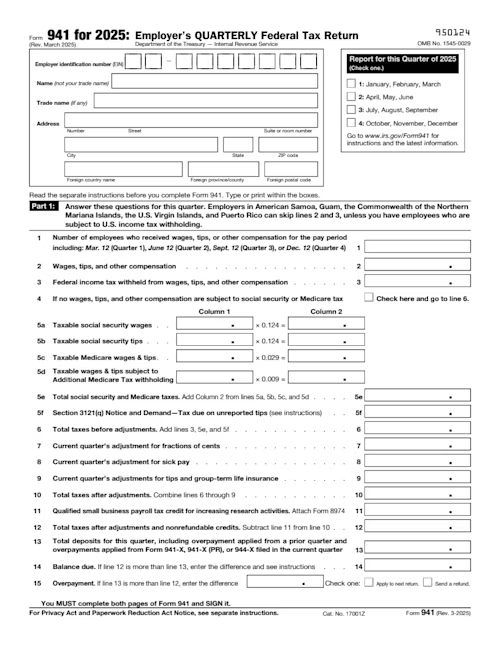

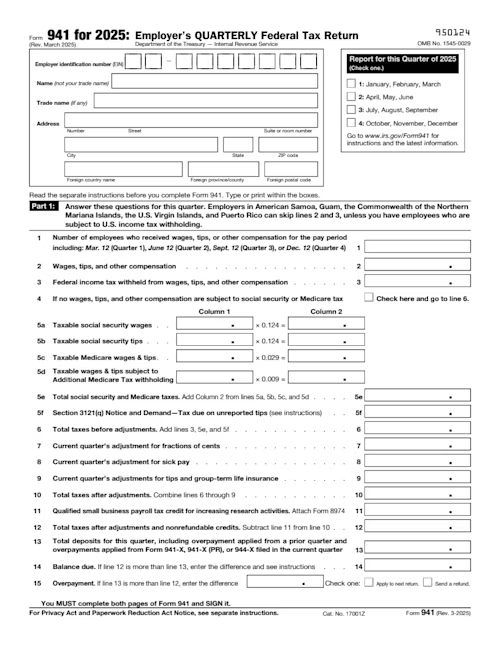

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.