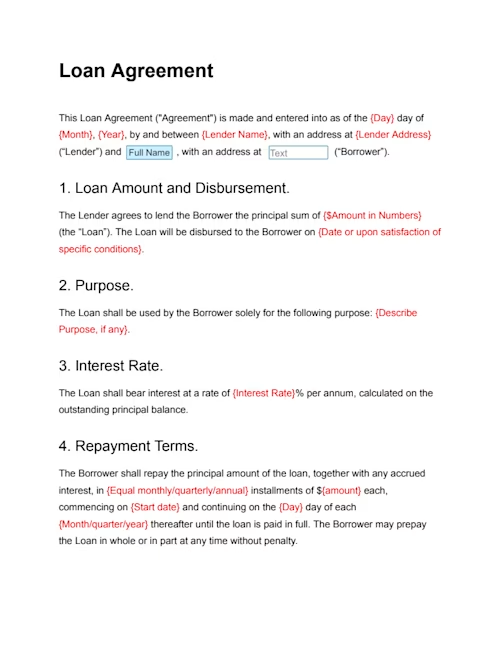

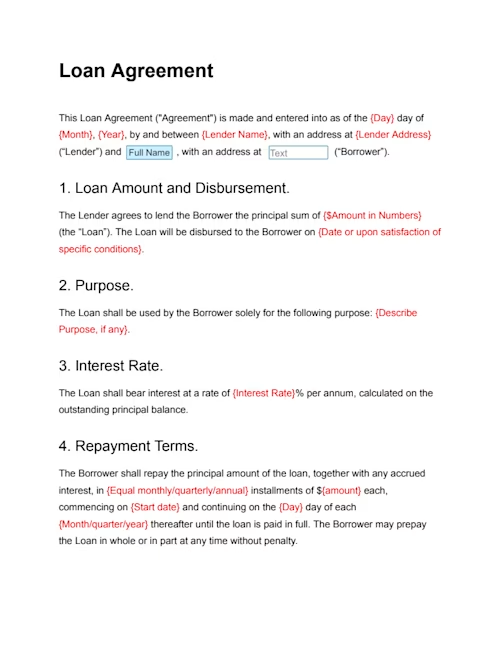

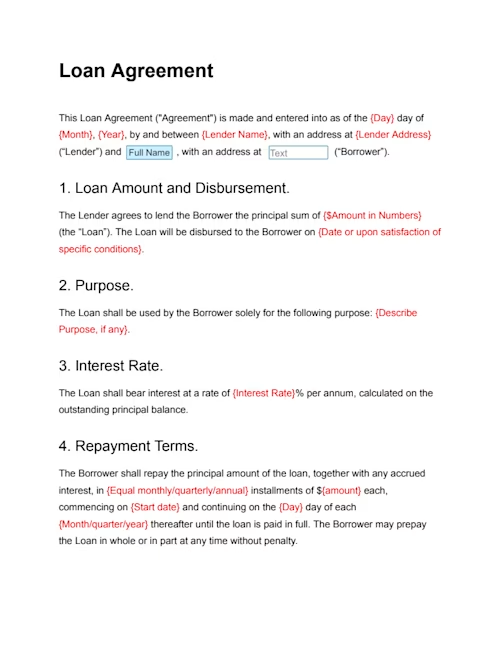

Loan Agreement

Put your loan in writing. Whether a friend or a business, our loan agreement template makes lending money safe and protects all parties.

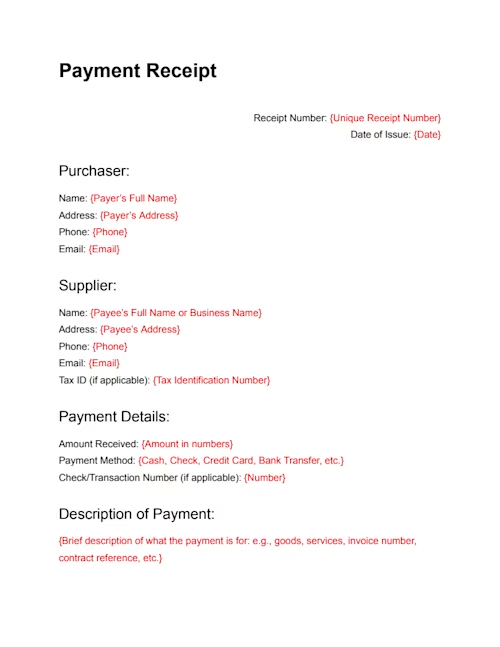

Provide proof of payment in seconds with our professional and customizable payment receipt template.

You will need to switch to a laptop, tablet, or desktop to use this template.

A payment receipt serves as proof of a transaction and provides a formal record of payment for goods or services. Also known as a receipt of payment or a sales receipt, if you're a business owner or an individual, a payment receipt helps maintain accurate financial records and can be referenced for accounting or tax purposes.

With Docusign, you can easily spin up a payment receipt using our free, fillable sales receipt template that allows you to populate it with all the finer details of the transaction, such as the amount paid, date, and description of goods or services. The great news is all of this can be done online within Docusign’s award winning, document-editing experience.

After you fill out the receipt, you can download, print, or send it electronically for signatures through Docusign. All you need to do is sign up or log into your Docusign account. Click on the payment receipt template below to get started:

Streamline how you track payments with our standard sales receipt template. Use Docusign to edit, customize and send it out for a secure signature (if applicable). This method provides both parties with a clear, reliable record that is securely stored in your account in case you need to refer back to it. Elevate the security and professionalism of your purchase receipts. Start using Docusign today to manage every sales transaction with confidence.

A payment receipt is a formal document provided by a seller or service provider to a buyer confirming that payment has been received for goods or services. It serves as proof of transaction and typically includes details such as the amount paid, date of payment, method of payment, and a description of the purchased items or services.

According to the Small Business Administration, receipts are essential for accurate bookkeeping, tax preparation, and resolving disputes.

You should provide a payment receipt whenever a customer completes a payment, whether it’s for products, services, deposits, or partial payments. Receipts are especially important for:

Verifying payments for both parties

Tracking business income for accounting and tax purposes

Providing customers with proof of purchase, which may be needed for returns, warranties, or expense reimbursement

For businesses, issuing receipts consistently helps maintain transparency and builds customer trust.

To ensure a payment receipt is legally valid and meets standard business and tax requirements, it must include the following elements:

Receipt number: A unique identifier for tracking and reference.

Date of issue: The date the receipt is generated.

Payer’s information: Full name, address, phone, and email of the person or entity making the payment.

Payee’s information: Full name (or business name), address, contact information, and tax identification number (if applicable) of the recipient.

Amount received: Clearly state the amount in both numbers and words to avoid discrepancies.

Payment method: Specify how the payment was made (e.g., cash, check, credit card, bank transfer).

Description of payment: Briefly describe the nature of the payment (e.g., what goods or services were provided, invoice number, contract reference).

Date of payment: The actual date the payment was made.

Payee’s signature and printed name: To authenticate the receipt.

While not always required, the following elements can provide additional clarity and professionalism:

Check/transaction number: For reference if payment was made by check or electronic transfer.

Balance information: Show amount due before payment, amount paid, and any remaining balance (useful for partial payments or ongoing accounts).

Company stamp or seal: Adds authenticity, especially for businesses.

Legal disclaimer or notes: Any important notes, terms, or legal statements.

Retain for records statement: Remind recipients to keep the receipt for future reference.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Put your loan in writing. Whether a friend or a business, our loan agreement template makes lending money safe and protects all parties.

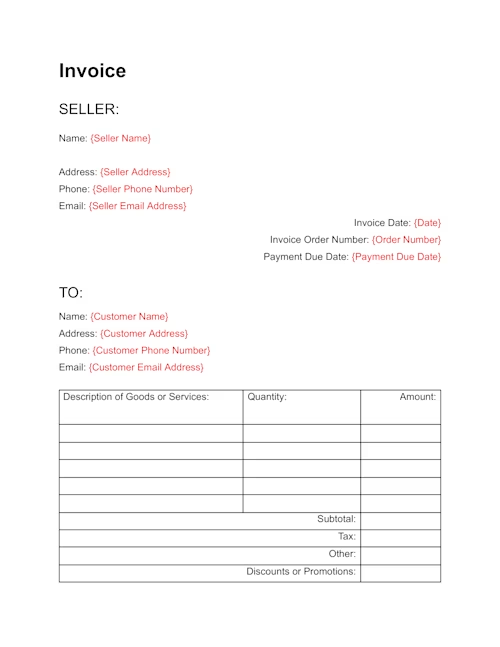

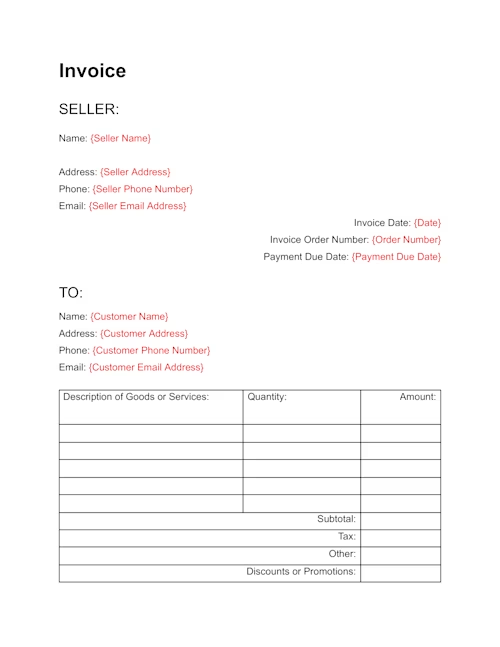

Time to bill your client? Our professional invoice template is customizable so it's easy to edit, detail charges and change payment terms.

Put your loan in writing. Whether a friend or a business, our loan agreement template makes lending money safe and protects all parties.

Time to bill your client? Our professional invoice template is customizable so it's easy to edit, detail charges and change payment terms.

No. An invoice is a request for payment issued before the transaction is complete, while a receipt confirms that payment has been received.

Yes. Digital or electronic receipts are widely accepted and can be sent via email or apps, often improving record keeping and reducing paper waste.

The IRS recommends keeping receipts and other financial documents for at least three years to support tax filings and audits.