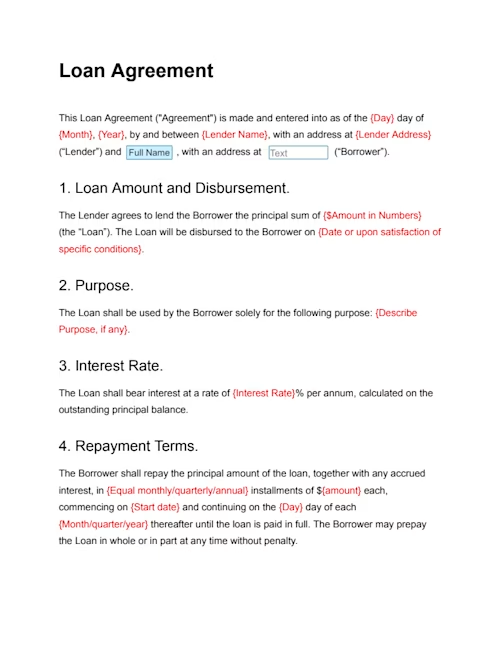

Loan Agreement

Put your loan in writing. Whether a friend or a business, our loan agreement template makes lending money safe and protects all parties.

Time to bill your client? Our professional invoice template is customizable so it's easy to edit, detail charges and change payment terms.

You will need to switch to a laptop, tablet, or desktop to use this template.

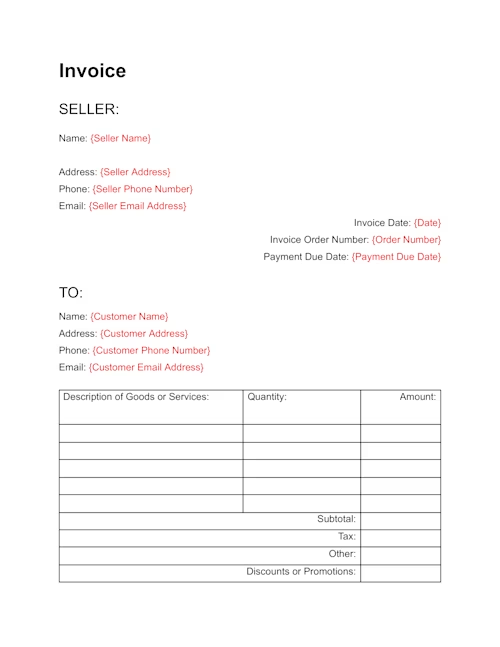

An invoice is an essential document for any business, providing a formal request for payment for goods or services. Our sample invoice details what was sold, the quantity, agreed-upon prices, and the total amount due, so you and your client are aligned on payment expectations while maintaining accurate financial records.

Our free invoice template offers a simple, professional way to bill clients. It helps you set clear payment terms from the start, reducing misunderstandings and streamlining your billing process.

Our standard invoice template includes all key components of a standard invoice and is easy to customize. Update sections such as your business address and client information, item descriptions, quantities, unit prices, totals, and payment terms.

Designed for customization, the invoice template is ready to fill out and send online using Docusign. Once completed, the invoice is securely stored in your Docusign account, where you can download or print out the invoice whenever needed.

An invoice is a formal document sent by a seller to a buyer to ask for payment for goods or services provided. It serves as a record of the transaction, detailing the items sold, the agreed-upon price, and the payment terms.

Payee vs. Payor: The payee is the party receiving the payment (typically the seller or service provider). The payor is the party making the payment (typically the buyer or customer).

Invoices are essential for both parties as they help track payments, manage finances, and provide a legal record of the transaction.

A standard invoice template typically contains the following elements:

Statement of invoice: clearly state that this is an invoice at the top of the document.

Invoice number: all invoices should have a unique identifier called the invoice number. This signifier is used to catalog all invoices a business sends in order, so they can be quickly referenced in the future.

Vendor and client contact information: includes the names, addresses, phone numbers, and often email addresses of each party.

Issue date: the date an invoice is sent is an important record for ensuring that both the vendor and customer are complying with the terms of payment.

Terms of payment: even if the terms of payment are established in a separate document such as a contract or purchase order, they should also be included in the invoice for proper documentation.

An itemized list of goods or services being purchased: include a complete accounting of what was provided, along with the units for each.

Taxes, fees, credits, and penalties: include the price of the goods or services being provided and anything else that will impact the total cost, including any taxes, credits for previous deposits, or late fees from previous invoices.

Amount owed, and total amount if applicable: if the payment terms call for payments to be made in installments, the amount owed for each installment should be listed, including the total amount due for the first payment along with the total amount due.

There are several types of invoices tailored to different business needs:

Standard Invoice: A basic invoice used for most one-time transactions, detailing the goods or services provided and the total amount due.

Commercial Invoice: A commercial invoice is a legal document issued by the seller to the buyer during an international transaction. It serves as a customs declaration and provides details about the goods being sold, their value, and other relevant information for customs clearance.

Freelancer Invoice: A freelancer invoice is a bill that a self-employed individual (freelancer) sends to their client to request payment for services rendered. It details the work performed, the hours spent, the agreed-upon rates, and the total amount due.

Contractor Invoice: A formal document issued by a contractor to a client to request payment for services rendered or goods supplied. It serves as a record of the transaction and outlines the amount due for the work completed.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Put your loan in writing. Whether a friend or a business, our loan agreement template makes lending money safe and protects all parties.

Put your loan in writing. Whether a friend or a business, our loan agreement template makes lending money safe and protects all parties.

An estimate is an estimated cost provided by a seller to a potential buyer for goods or services. It is not a final invoice but a formal document that outlines pricing and terms for a future transaction.

Purpose: An estimate helps customers understand the expected costs before agreeing to proceed with a project or service. It is often used in industries like construction, event planning, or consulting.

Comparison to Invoice: Unlike an invoice, which asks for payment after a service is provided or goods are delivered, an estimate is issued beforehand as a cost estimate. Once an estimate is accepted, it can later be converted into an invoice.

A proforma invoice is a preliminary invoice issued by a seller to a buyer before goods are delivered or services are rendered. It acts as a commitment to provide the specified products or services at the agreed price.

Proforma invoices are crucial for ensuring transparency and accuracy in transactions, especially when negotiating terms with international buyers or regulatory authorities.