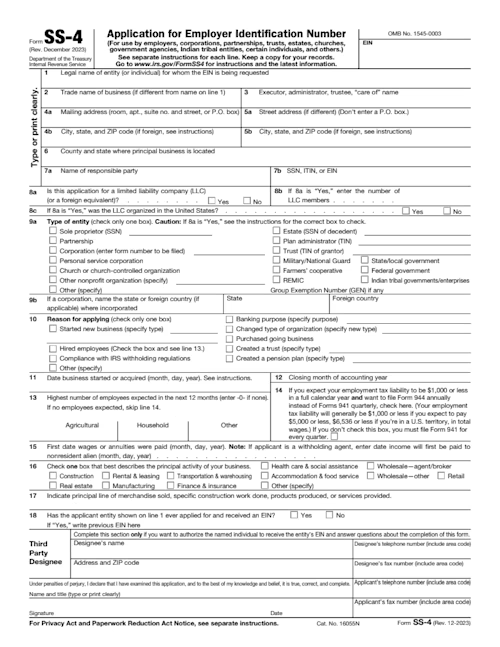

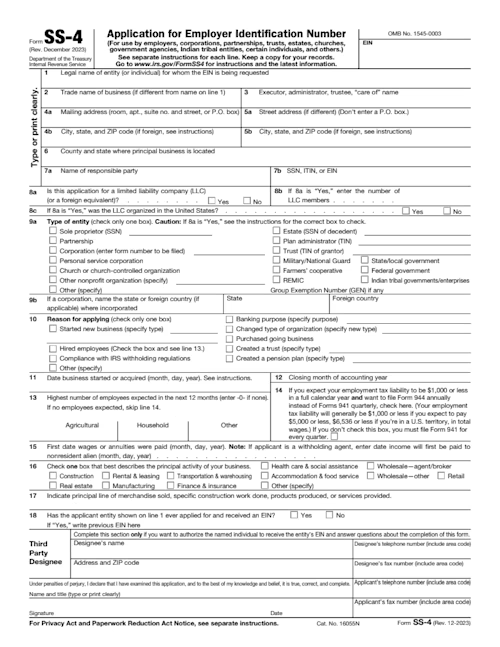

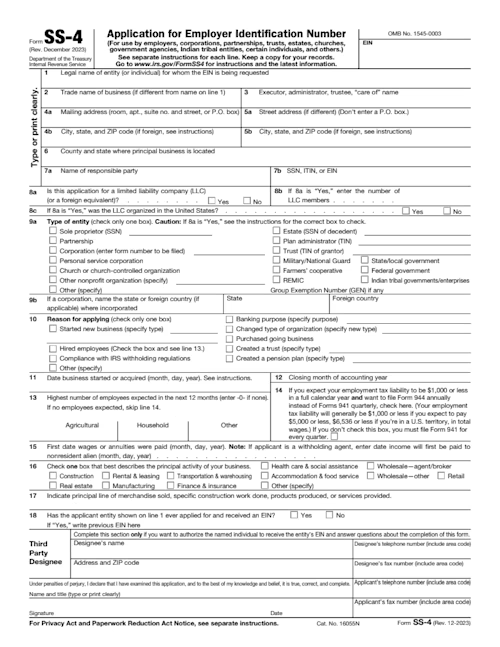

SS-4 form

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

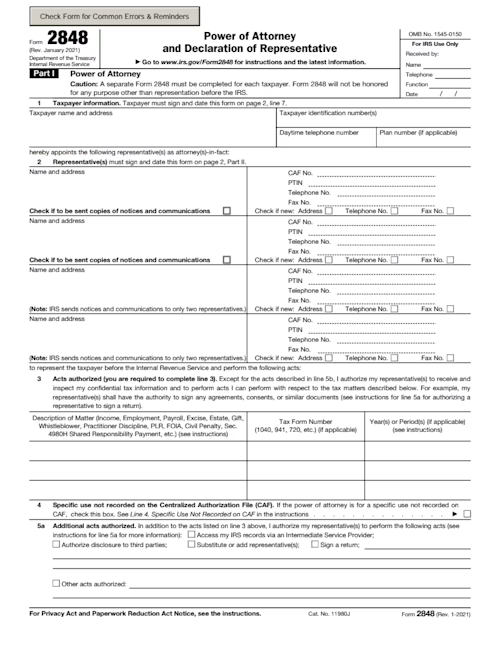

Grant power of attorney for tax matters. Fill out our form 2848 template to appoint a representative for all your IRS dealings.

You will need to switch to a laptop, tablet, or desktop to use this template.

The IRS Form 2848, Power of Attorney, is the formal way you give someone else permission to handle your taxes directly with the IRS. It grants a trusted representative, like a tax attorney or accountant, the authority to speak and act for you in front of the IRS, ensuring your tax matters are handled by an expert. This completed government form ensures the IRS knows exactly who is authorized to represent you.

Docusign’s free, editable Form 2848 template is just like the one the IRS provides in PDF, but we take the guesswork out of the paperwork. We’ll guide you through the necessary fields online, ensuring you can quickly and accurately grant representative authority so you can let someone else do your taxes (thankfully!).

When you've filled in the 2848, click below and you can use Docusign to securely sign, manage, store, download and print the document from the comfort of your Docusign account..

To ensure your tax matters are handled by a qualified professional you trust, filing Form 2848 is the proper procedure to let them be your mouthpiece. Using a Docusign template to prepare and sign the form ensures the process is smooth and your records are secure. Ready to authorize your representative? Get going with a free Docusign account.

Form 2848, also known as the Power of Attorney and Declaration of Representative, is an IRS form that authorizes an individual to act on behalf of a taxpayer in matters before the IRS. This can include signing tax returns, receiving confidential tax information, and representing the taxpayer during audits, appeals, or other tax-related proceedings (IRS: About Form 2848)

Form 2848 is essential for businesses, tax professionals, and individuals who need someone else—such as an accountant, attorney, or enrolled agent—to communicate with the IRS on their behalf. It ensures that the IRS recognizes the representative’s authority and protects the taxpayer’s rights.

Any taxpayer who wants to allow another individual to represent them before the IRS must submit Form 2848. Common scenarios include:

Businesses authorizing accountants or tax professionals to handle corporate filings or audits

Individuals granting a power of attorney to a tax preparer or legal representative

Situations involving multiple tax matters where a professional manages correspondence and negotiations with the IRS

Form 2848 is not mandatory unless the taxpayer wants a representative to act on their behalf, but it is highly recommended for anyone facing audits, appeals, or complex tax issues (IRS Instructions for Form 2848).

Form 2848 can be submitted electronically through IRS-authorized e-file providers or mailed directly to the IRS. Electronic submission allows for faster processing and easier recordkeeping. Systems ensure that:

All required fields are complete and accurate

The electronic signature is valid and attributable to the taxpayer

The IRS can verify the representative’s authority

While Docusign can be used to collect signed authorization forms securely, the actual filing with the IRS must follow approved electronic channels or traditional mailing procedures.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

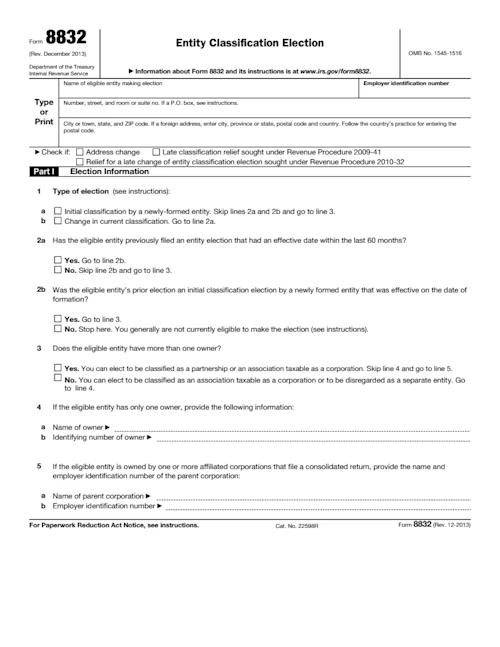

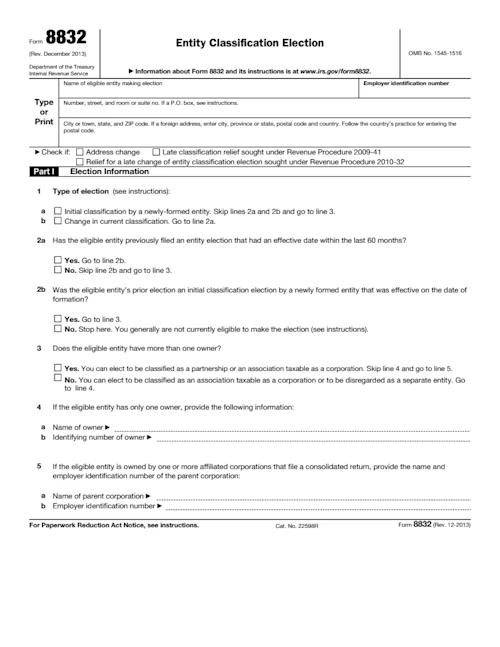

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

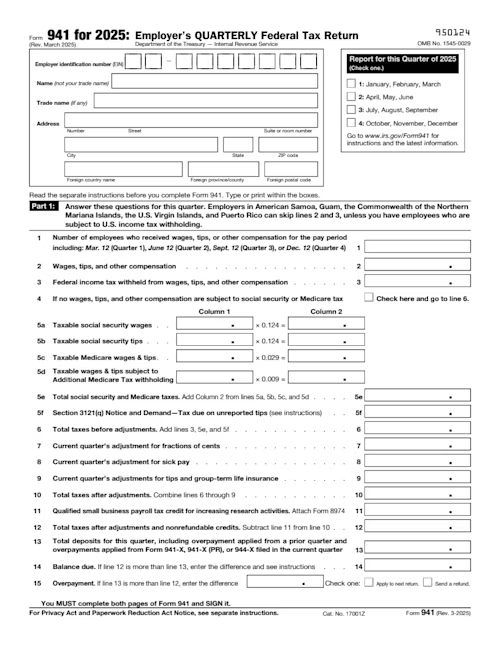

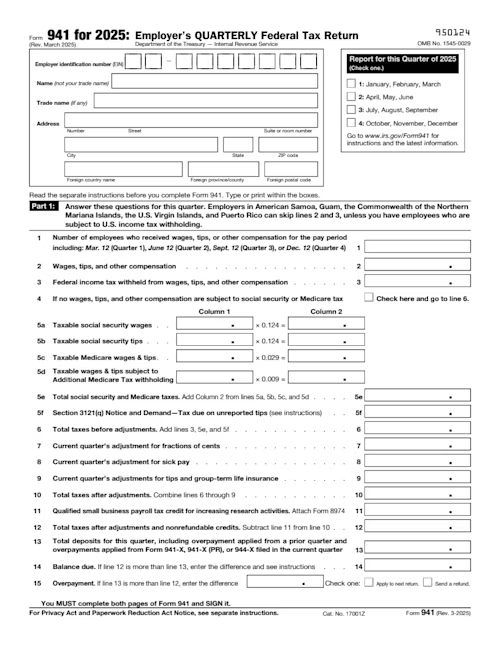

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.