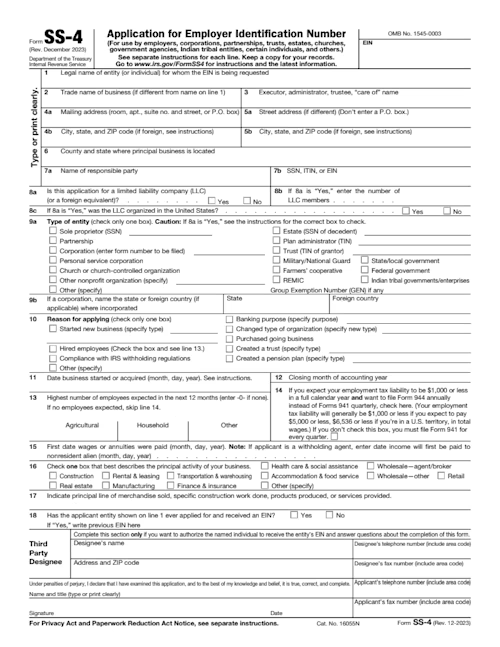

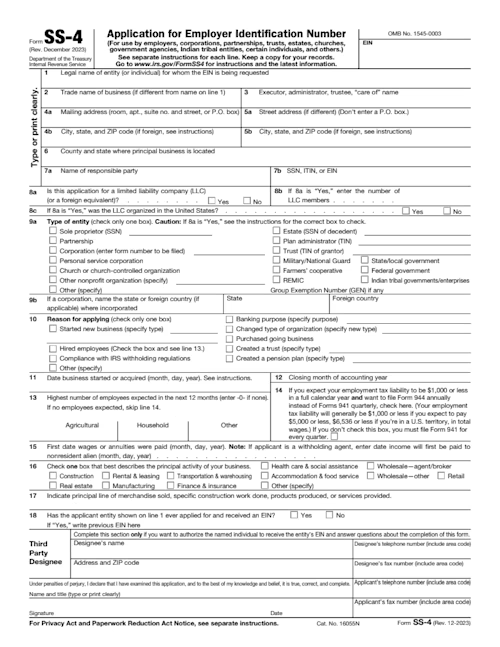

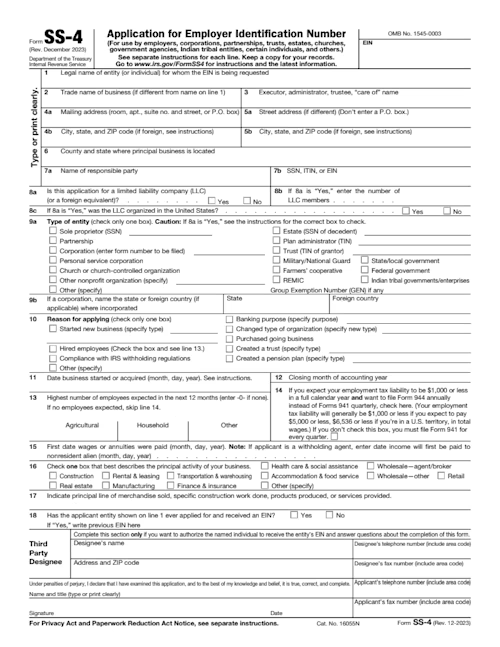

SS-4 form

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

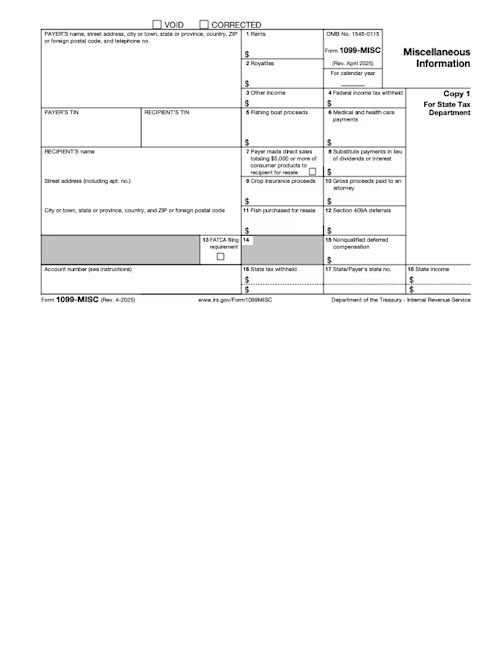

Tax season is here! Easily populate 1099s for your independent contractors. Don't wait until the deadline. Use our 1099 template.

You will need to switch to a laptop, tablet, or desktop to use this template.

A 1099 form is a common tax document used to report income earned outside of a regular employer-employee relationship. The 1099 is often used to report earnings from freelance work, independent contracting, rental income, investments, and gambling winnings.

Whether you’re issuing it as a business to a contractor or receiving it as a self-employed professional, Docusign’s free, fillable 1099 form gives you a straightforward way to record payments, making the stressful tax season less stressful. Our 1099 template includes all required sections, from payer and recipient details to total income and applicable tax withholdings, ensuring IRS compliance. You can edit and use our 1099 template online - all you need is a free Docusign account to get started.

Simplify your year-end tax process and help avoid IRS penalties with Docusign's fillable template for Form 1099. Unlike a static PDF or the one you receive from the version from the IRS, using Docusign allows you to securely store the file forever and access it whenever you need. Essential for both small business owners and individual contractors, our sample template provides a clear, official record that protects both parties and streamlines tax filing.

Use a 1099 form template in Docusign. You can do this with your existing Docusign account or by signing up for a free trial.

Once you’ve edited the template to fit your needs, you can easily send the document via Docusign envelope to the parties who need to add information and sign the agreement. After the agreement has been signed and completed, you can find the agreement in your Docusign account.

A 1099 form is a document used by the Internal Revenue Service (IRS) to track various types of income that are not part of regular employment wages. In essence, it acts as a financial record that helps the IRS monitor income sources that haven't had taxes withheld throughout the year.

The type of 1099 form you send or receive depends on the specific type of payments made. The most common types of 1099 forms include:

Form 1099-NEC (Non-Employee Compensation) is used to report non-employee compensation paid to independent contractors, freelancers, or self-employed individuals. Payers are required to issue a Form 1099-NEC if they pay a recipient $600 or more during the tax year for services performed.

Form 1099-INT (Interest Income) is used to report interest income earned from various sources, such as bank accounts, certificates of deposit (CDs), savings accounts, or loans. A financial institution will issue Form 1099-INT if you earn at least $10 in interest income during the year.

Form 1099-DIV (Dividend Income) is used to report dividend income received from stocks, mutual funds, or other investments. It also includes capital gains distributions. You will receive a Form 1099-DIV if you receive at least $10 in dividend income during the tax year.

Form 1099-MISC (Miscellaneous Income) is a versatile form used to report various types of income that don't fit into other 1099 categories. This includes payments to independent contractors, rent, royalties, and other miscellaneous income. Payers issue Form 1099-MISC if they make payments of $10 or more in royalties or $600 or more for other services.

Form 1099-B (Broker and Barter Exchange Transactions) is used by brokers to report the sale of stocks, bonds, or other securities. It provides information on the proceeds from these transactions, which helps recipients calculate their capital gains and losses. There is no minimum threshold for Form 1099-B.

Form 1099-S (Proceeds from Real Estate Transactions) is used to report proceeds from the sale or exchange of real estate. It is typically provided by the person responsible for closing the transaction, such as a title company or real estate agent. Form 1099-S is issued when the gross proceeds from the real estate transaction are $600 or more.

Form 1099-G (Certain Government Payments) reports certain government payments, such as unemployment compensation, state tax refunds, and other government program payments. You will receive a Form 1099-G if you received at least $10 in government payments during the year.

Form 1099-K (Payment Card and Third-Party Network Transactions) is used to report payment card and third-party network transactions, which are typically related to online or electronic payment systems, like PayPal. Before December 23, 2022, payment processors issued Form 1099-K to sellers with 200 transactions and $20,000 in gross payments during the year. However, after December 23, 2022, the threshold has been lowered to $600 in an effort to bring it in line with other 1099 forms.

Receiving a 1099 form depends on how you make your income. Individuals or entities that make payments to you are required to send a 1099 form to both you and the IRS if your income meets the specified threshold.

There are a few common types of people who receive 1099 forms:

Independent contractors who provide services as independent contractors or freelancers and receive payments totaling $600 or more from a single client during the year.

Freelancers, like graphic designers, consultants, or writers, who accumulate $600 or more in earnings from a single client or entity, are also issued a 1099-NEC.

Those who earn interest, dividends, or other investment income will receive a 1099-INT, 1099-DIV, or similar forms, depending on the nature of the income.

Landlords who receive $600 or more in rent during the year from a tenant will receive a 1099-MISC.

Those who receive royalties, prizes, awards, and other sources of non-employment income may receive a 1099-MISC.

The rationale behind these forms is twofold: First, they help individuals and businesses that have made payments to you to report these expenses on their own tax returns. Second, 1099 forms serve as a checks-and-balances system, ensuring that taxpayers accurately report all sources of income, reducing the likelihood of underreporting.

If you fail to report income that should be included on your 1099 form, you might face penalties and interest charges, so accurate and timely reporting is important.

Understanding the timeline for 1099 forms is essential for effective tax planning. The general key dates to remember are as follows:

January 31: This is the deadline for businesses to send 1099 forms to recipients. If you were paid for work in the previous year, you should receive your copy of the form by this date.

February 28: If you are filing paper forms with the IRS, this is the deadline for submitting your 1099.

March 31: For electronic filers, this is the deadline to submit 1099 forms to the IRS.

It's important to adhere to these deadlines to ensure that you remain in compliance with tax regulations and avoid potential penalties.

There is no such thing as a "1099 employee." Instead, the term "1099 employee" is often a misunderstanding or a misnomer. When people refer to a "1099 employee," they are typically talking about individuals who work as independent contractors, freelancers, or self-employed professionals and receive income reported on a Form 1099-NEC (Non-Employee Compensation) or Form 1099-MISC.

When someone is considered a "1099 worker," they are typically not an employee of the company or individual who hires them. Instead, they are independent contractors or self-employed individuals who provide services on a project basis. They are responsible for managing their own taxes, healthcare, and other benefits, as they are not eligible for the same benefits and protections that traditional employees receive.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

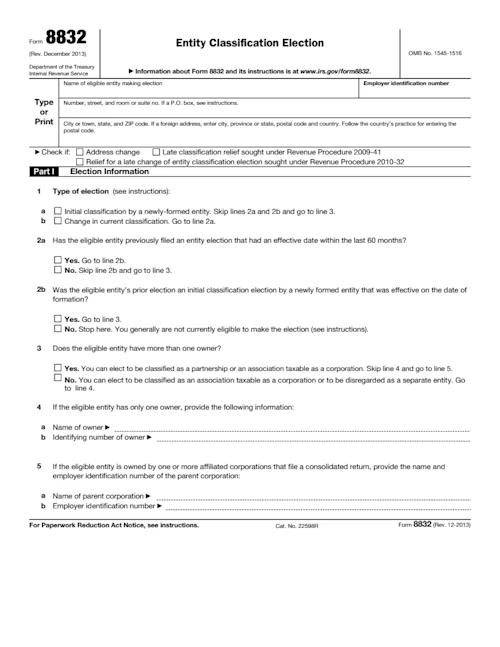

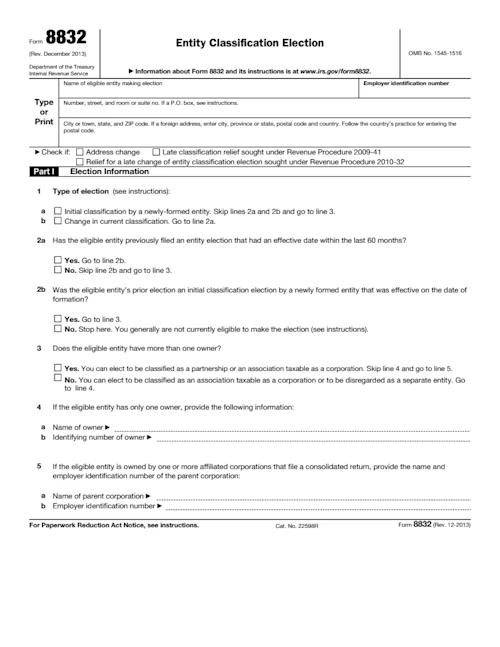

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

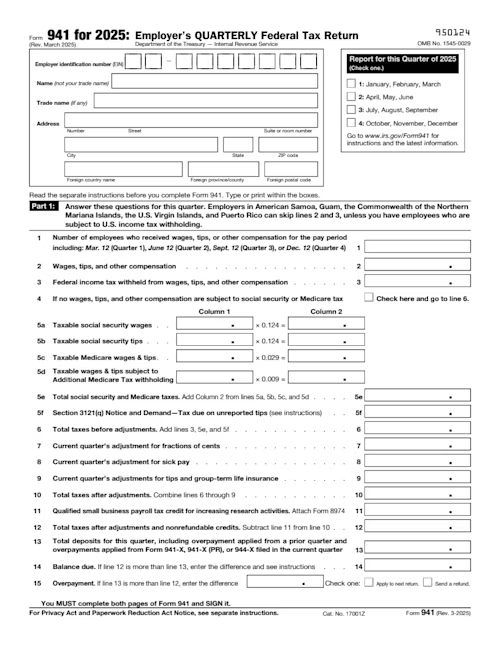

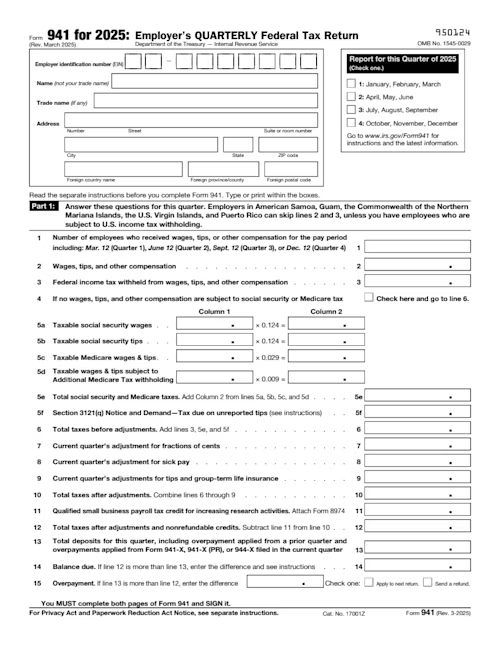

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

Get your EIN today. Use our fillable SS-4 form to apply for your business tax ID number so that your business entity is IRS compliant.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.