Docusign IAM | eSignature

Easily send and sign documents with Docusign eSignature

Make your business faster, simpler and more cost-efficient with electronic agreements. Agree with confidence, with intuitive signing experiences across virtually any device.

eSignature is now part of Docusign IAM.

Docusign eSignature by the numbers

How can your team save time and money by using eSignature?

- 15minutes or less to complete 44% of agreements, and 1 day or less to complete 79% of agreements

- $36saved per document on average by reducing hard costs and improving employee productivity

- 99.9%uptime, with no maintenance downtime

- 400+secure, pre-built integrations to the applications you use every day

eSignature transforms how you create, commit to and manage agreements as part of Docusign IAM.

Improve your customers’ experience

Consumers, partners, employees and vendors expect convenient, fast agreement experiences. Enable them to sign practically any type of agreement on almost any device.

And provide more intuitive experiences for your customers through custom branding and responsive signing.

Boost business efficiency and reduce costs

Empower your teams to quickly prepare, route and approve agreements so they can focus on the big picture.

Get going quickly with dynamic document generation, collaborate with comments and shared templates and take advantage of configurable workflows to tackle your trickiest agreement challenges.

Increase security and make compliance easier

Protect your agreements with enterprise-grade security and compliance controls without sacrificing the user experience. Get an added layer of security with enhanced signer identification and robust threat detection capabilities.

Connect with all of the tools you already use

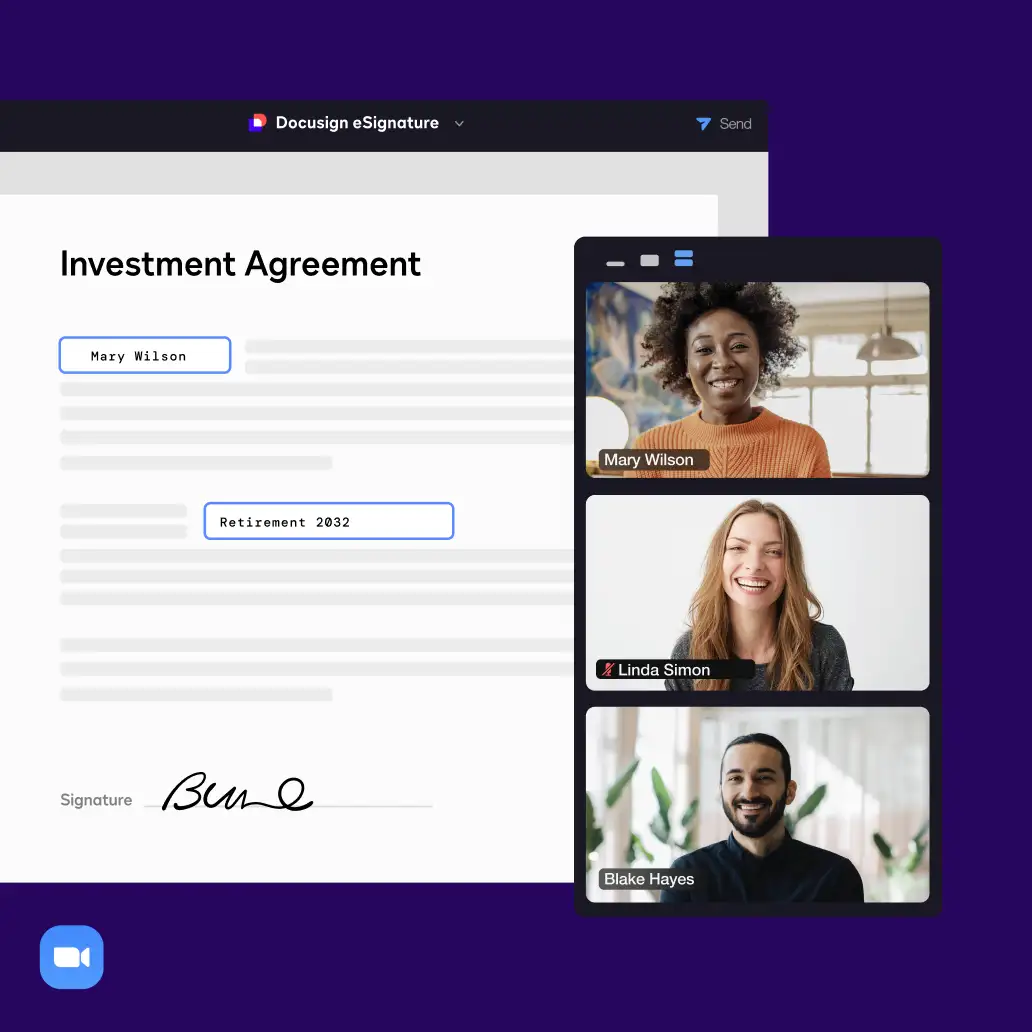

Easily integrate your agreements with your apps of choice, including Salesforce, Microsoft, Google, Zoom and more. Connect and extend your signature workflows with an industry-leading number of pre-built integrations and award-winning APIs.

Start your 30-day free trial

Start sending and signing in minutes with eSignature.

Extend the power of eSignature

Docusign regularly releases new innovations to help your organization enable better ways of working. Here are a few notable innovations.

SMS and WhatsApp delivery

Get agreements signed faster with notifications delivered to signers’ mobile devices.

Learn MoreAdvanced workflows

Add more flexibility, control and ease to your eSignature workflows.

Learn MoreMonitor

Protect your agreements with activity tracking.

Learn MoreWeb Forms

Streamline data collection and speed up signing.

Learn More

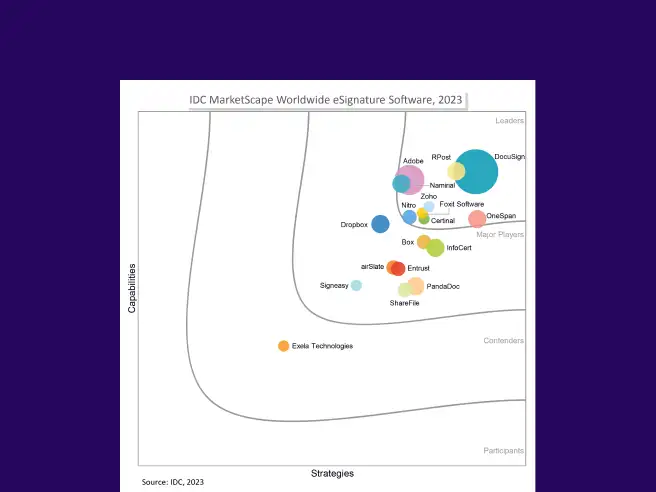

1 million customers and 1 billion users trust Docusign to…

Electronic signature guides and resources

Go beyond eSignature. Manage your entire contract lifecycle.

FAQs

An electronic signature is a catch-all term for any electronic process that indicates acceptance of an agreement or a record. The U.S. Federal ESIGN Act defines an "electronic signature" as “an electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record.”

Electronic signatures have been used for electronically signing offer letters, sales contracts, permission slips, rental/lease agreements, liability waivers, financial documents, etc. They are legally enforceable in most business and personal transactions worldwide. Learn more in our eSignature Legality Guide.A digital signature is a type of electronic signature generated via a digital certificate. A digital signature helps securely associate a signer with a specific document. Digital signatures form a digital “fingerprint” and can be used to validate signer identity and demonstrate that the signed document has not been tampered with.

The terms “electronic signature” and “digital signature” are often conflated. For the vast majority of agreements and records, an electronic signature is sufficient. A digital signature is a subset of electronic signature that adds another layer of security to a signed document. A digital signature is supported with a digital certificate and uses Public Key Infrastructure (PKI), which adds proof of signer identity and enhanced security to a legally enforceable signature.

Yes, e-signatures are legally recognized around the world. In the U.S., the ESIGN Act, which was signed into law in 2000, grants legal recognition to electronic signatures and records if all parties to a contract choose to use electronic documents and to sign them electronically. Many foreign jurisdictions also recognize the legal effect and admissibility of electronic records. An electronic signature, like those supported by Docusign eSignature, is typically all that is needed to create a legally enforceable document. There are laws that demand certain requirements for e-signatures to be deemed legally enforceable. Using a safe, secure service like eSignature can help you meet these requirements.

The majority of commonplace agreements and forms can be signed electronically. Examples of documents that may be signed electronically include NDAs, purchase orders, vendor agreements, insurance claims and hiring contracts.

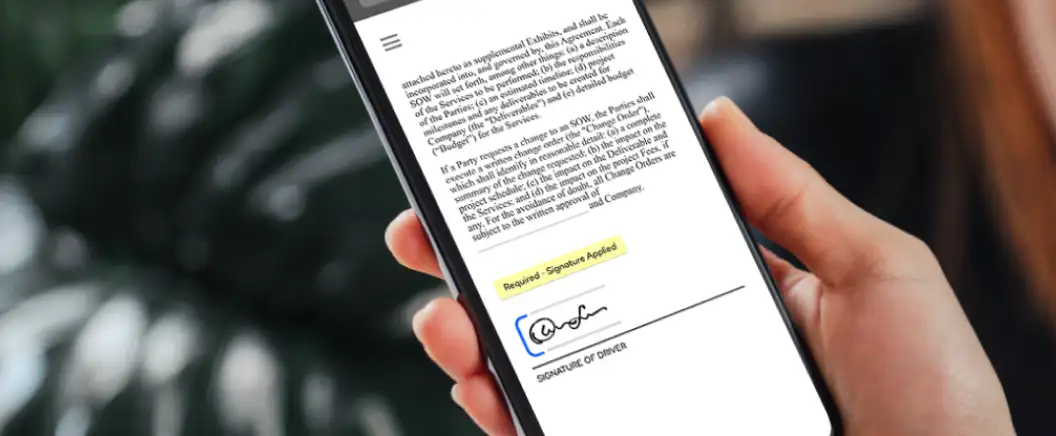

With Docusign eSignature, signing is always free. Recipients click a link to open the agreement on a device of their choice, such a mobile phone, tablet or computer. Tabs and simple instructions guide the user through the signing process, even adopting an electronic signature. The recipient clicks Finish to save the signed document.

With Docusign eSignature, you can upload documents in formats such as Microsoft Word, PDF or other common formats. You can upload documents from your computer or popular file-sharing sites like Box, Dropbox, Google Drive and OneDrive.

Ready to make your organization more efficient?

Start your free trial today

Try Docusign eSignature for 30 days. No credit card required.

Contact Sales

Our team would love to help you find the perfect fit of products and solutions.