Partnership Agreement template

Don't start a partnership on a handshake alone. Protect your venture with our partnership agreement template that outlines everything.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 21, 2026

- Created by Docusign

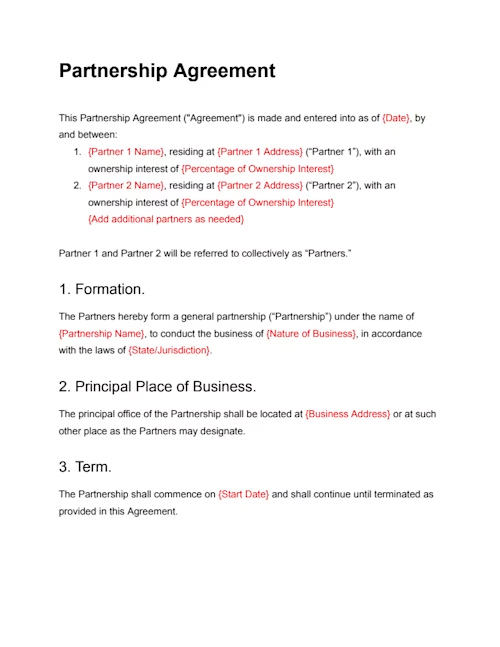

Free partnership agreement template

A partnership agreement is a business document that outlines the responsibilities, roles, and profit-sharing arrangements of partners in a business venture. Also known as articles of partnership, this contract serves as the foundation for how the business will operate and addresses potential conflicts, decision-making processes, and financial contributions.

Whether you're starting a small business with a close friend or a larger venture with multiple partners, a partnership agreement is essential to ensure all parties are aligned on their roles and expectations.

Using Docusign’s partnership agreement template you can edit and customize the online form to fit your specific business arrangement. Once filled out, you can download, print, or send it for signatures all within the Docusign experience. Click on the partnership agreement sample below to get started:

Our partnership contract provides a legal framework for your business relationship, it also streamlines the signing process, making it secure and easy to track. Get started with Docusign today to ensure that your partnership is legally enforceable and efficiently managed.

What is a partnership agreement?

A partnership agreement is a document that dictates how two or more people will work together in a business relationship. The agreement lays out each partner’s responsibilities in the business on a day-to-day basis and in the long-term. It also clarifies how much of the business each partner owns and how much profit and loss each partner is accountable for.

The purpose of a partnership agreement is to set the terms of a business relationship between two or more cooperating parties as clearly as possible. Once signed, this agreement can be used to determine responsibility and fault in case questions or conflicts arise during the partnership. It can also be used as evidence of partnership in a court of law.

When do you need a partnership agreement?

Written partnership agreements are not required by law, but whenever you and at least one other person decide to go into business together, you should draft one as soon as possible.

Partnership agreements act as contracts between you and your partner. Without a written agreement, the parameters of a partnership aren’t clearly defined. This could lead to contentious disagreements and even costly legal battles.

There are other reasons to get everything in writing: Without an official partnership agreement, your operation will be governed by generalized state partnership laws. These laws differ from authority to authority and may force you to accept terms and consequences you didn’t intend.

What are the different types of partnership agreements?

There are four major types of partnership agreements:

General partnerships

This is the most simple form of partnership agreement. In general agreements, all business partners have total liability for the company. They share responsibilities in managing the business and each have the ability to agree to business contracts and loans on its behalf. Interests and profits can be split any way the partners decide. General partnerships are common because they’re easy to create and cheap to maintain. General partners don’t have to pay a formation filing fee, ongoing state fees, or franchise taxes.

Limited partnerships

In a limited partnership, some partners assume more responsibility for regular business activity than others. The “limited” partners may provide capital contributions and earn some share or profits, but they will likely not be an active participant in the day-to-day management of the business. Limited partnerships are helpful because only full partners have full liability of the business. This means limited partners won’t be legally held responsible for paying any debts the business accrues, using their personal assets. Meanwhile, full partners can conduct business the way they see fit without oversight from their limited partners.

Limited liability partnerships

These partnerships are considerably less common than general or limited partnerships, and aren’t allowed in every state. In limited liability partnerships, all partners (full or limited) are still responsible for regular business operations, debts, and liabilities. They are not responsible for errors such as malpractice made by other partners.

Limited liability partnerships are most commonly used by professional service businesses like accounting firms, attorneys, doctors, or dentists. They allow these professionals to assume full co-ownership of their business without assuming liability for debts resulting from their partner’s errors.

Limited liability limited partnerships

This is the newest form of business partnership, and also isn’t recognized in all states. These partnerships operate like limited partnerships, but extend the same liability protection that limited partners have to full partners. This means full partners won’t have to use their personal assets to pay for debts the business accrues. Limited liability limited partnerships are currently most common in the real estate industry. For example, a group of investors partnering to establish a chain of hotels might set up a partnership like this so they won’t be liable for debts the hotel company itself takes on. This way, the maximum financial amount the investing partners could lose on the deal is their initial investment.

What should be included in a partnership agreement?

Your partnership agreement should include each of the following sections:

Specification of partners: The names and contact information of all partners involved in the agreement.

Ownership: How much of the business each partner owns. This is usually expressed as a percentage.

Division of profit and loss: How much profit and/or loss each partner shares in. This section can also dictate when partners are allowed to withdraw their profit from the business.

Capital contribution: How much each partner is contributing to the start of the business. This section will also detail a plan for how partners will be repaid for their contributions.

Share of liability: How much liability each partner assumes for any debts the business accrues.

Length of partnership: How long the partnership will last. The agreement should include this information even if the partnership is designed to last an indefinite period of time.

Distribution of decision making: How the partners involved will make decisions that affect the company and each other’s stake in it. This section should include a detailed breakdown of how the partners will make decisions, how much authority each partner has in making these decisions, and what is required for a decision to be confirmed.

Withdrawal terms: How the partnership will handle the departure of a member.

Dispute resolution: How partners will litigate and resolve disputes with each other.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement. Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Start with eSignature or let our sales team build your perfect plan