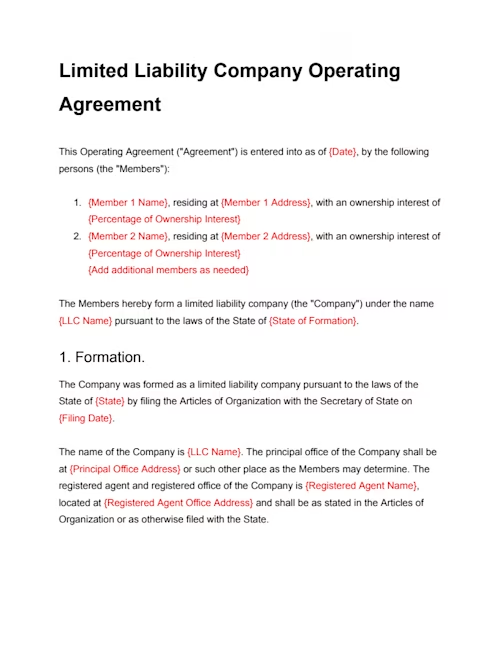

LLC Operating Agreement template

Formalize your LLC's structure. Create a custom LLC operating agreement for your new company with Docusign's standard contract.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 21, 2026

- Created by Docusign

Free LLC operating agreement template

To get your business off to a great start, a solid LLC operating agreement is your most important playbook. It clearly defines roles and procedures to prevent future headaches and misunderstandings to make sure all members are on the same page. If you don’t have an LLC operating agreement in place, your state default rules will dictate how your business operates.

So take control and establish the specific rules for your business with Docusign’s LLC operating agreement template. With our Limited Liability Company document, you can easily create, edit, finalize, and store a secure record of this foundational document, ensuring all members are protected. Take the first step towards a well-run business by getting started with a free Docusign account or clicking on the below LLC template below:

Taking the proactive step to create an LLC operating agreement is key to starting your business off right. This document puts your business on a solid foundation by establishing clear roles and procedures to avoid issues down the road. With Docusign, you can easily create, sign, and store a secure record that protects all members. Ready to formalize your business structure? Get started with a free Docusign account today.

What is an LLC operating agreement?

An LLC operating agreement is a legal document that outlines the ownership structure, management responsibilities, and operational procedures of a limited liability company (LLC). It governs how the LLC is run, how profits and losses are distributed, and what happens if a member leaves or the business dissolves. While some states don’t require LLCs to have an operating agreement, having one is highly recommended to prevent disputes and protect members’ personal liability.

When do you need an LLC operating agreement?

You need an operating agreement when:

Forming a new LLC, to legally document ownership percentages, management roles, and voting rights

Adding new members, to clearly outline responsibilities and profit distribution

Establishing financial procedures, including contributions, distributions, and handling company debts

Planning for potential disputes, buyouts, or dissolution scenarios

Even single-member LLCs benefit from an operating agreement, as it clarifies the separation between personal and business assets, which helps maintain limited liability protection (Investopedia).

What should be included in an LLC operating agreement?

A comprehensive operating agreement typically includes:

Company information

Name of the LLC

Principal office address

State of formation

Date of formation

Registered agent and office

Members

Names and addresses of all members

Initial capital contributions of each member

Percentage ownership or membership interests

Purpose

Description of the business purpose and permissible activities

Term

Duration of the LLC’s existence

Management structure

Whether the LLC is member-managed or manager-managed

Powers, rights, and duties of members or managers

Decision-making and voting procedures

Allocations and distributions

How profits, losses, and distributions are shared among members

Meetings and records

Frequency and procedures for meetings

Record-keeping requirements

Bank accounts and fiscal year

Procedures for company funds

Fiscal year designation

Transfer of membership interests

Restrictions and process for transferring ownership interests

Admission of new members

Dissolution and winding up

Events that trigger dissolution

Distribution of assets upon winding up

Amendments

Procedures for modifying the agreement

Severability and governing law

Handling invalid provisions

State law governing the agreement

Signatures

Execution by all members with dates

Additional (optional) parts

While not strictly required, these additional provisions can provide clarity and further protect the LLC and its members:

Indemnification: Protection for members or managers against certain liabilities

Compensation and reimbursement: Rules for compensating members or managers and reimbursing business expenses

Buy-sell provisions: Procedures for handling a member’s exit, death, or incapacity

Dispute resolution: Mediation or arbitration clauses for resolving conflicts

Non-compete and confidentiality: Restrictions on members’ activities outside the LLC

Succession planning: Procedures for transferring interests in the event of a member’s death

Tax treatment: Election of partnership or corporate tax status, if applicable

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

LLC Operating Agreement FAQs

Yes. Most agreements include a process for amendments, which typically require member approval and written documentation.

No, but even in states that don’t require one, having an agreement is recommended to clarify expectations and protect members.

An operating agreement helps separate personal and business finances, reinforcing the LLC’s limited liability status and providing legal documentation in case of disputes.

Create a free account to start using this Docusign template now