Featured topic

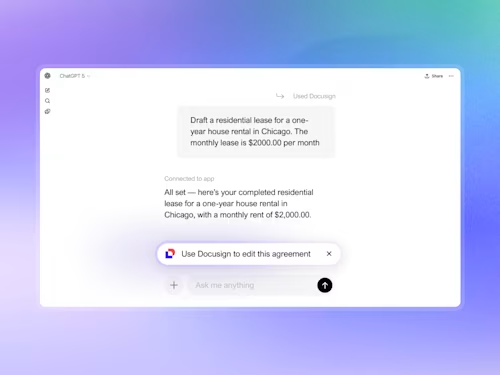

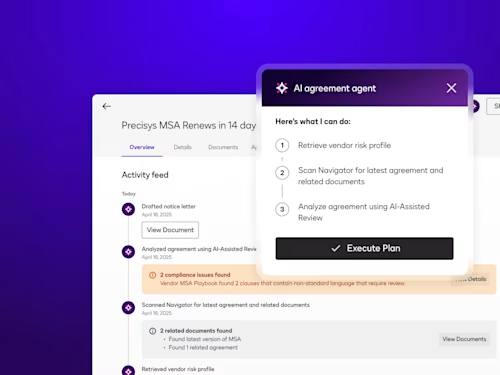

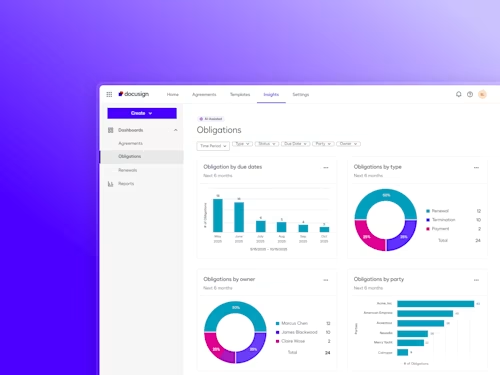

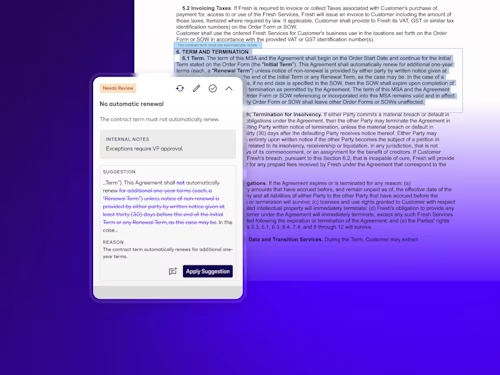

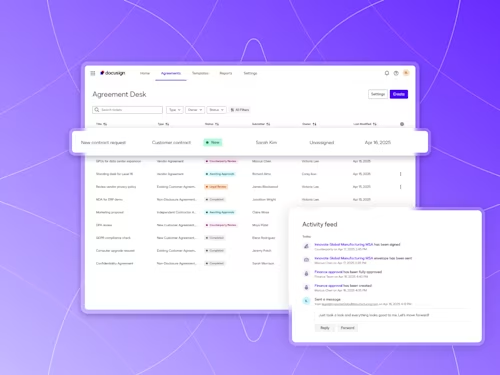

Intelligent Agreement Management

See how Intelligent Agreement Management helps organizations to create, commit to, and manage agreements through a single, streamlined workflow.

Popular posts

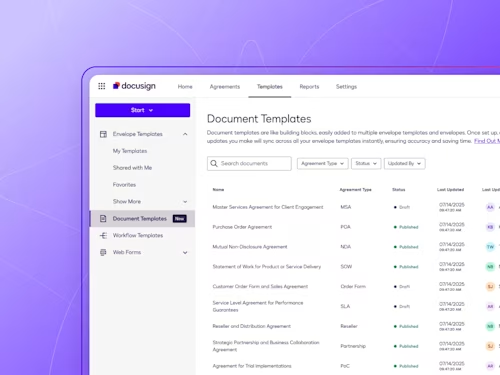

Digitize and Organize Your Agreements in a Central Repository

With Docusign IAM, all existing eSignature agreements are automatically stored in Navigator.

Agreement strategies and insights - delivered right to your inbox

Docusign IAM is the agreement platform your business needs