OptionsSwing educates investors by starting with a single click

Adopting Docusign Click for terms and conditions enabled this financial educator to streamline and validate new member signups.

“Docusign is a trusted brand and is legally binding, which helps add validity to what we do.”Jason Lee, Founder and CEO of OptionsSwing

Miami-based OptionsSwing provides financial education services to teach everyday investors how to trade in the stock market with stock options. With the emergence of commission-free stock trading platforms, such as Robinhood, Webull, and thinkorswim, anyone can become an investor by simply opening an account, transferring funds, and beginning to trade in just a few minutes. While this access to trading platforms is unprecedented, it can lead to significant stock losses for novice investors. That’s where OptionsSwing comes in.

OptionsSwing is a great option

In August 2019, OptionsSwing was created to help the masses invest by providing information via Instagram about what they were trading. They grew their following to more than 140,000 in only one year. Their audience is the average investor of all age ranges, from 18 to more than 60, and all demographics. Their revenue model is based on a subscription service, either monthly or annually, which has grown to more than 2,200 subscribers. The service is based on a Discord community, where members can ask questions and trade along with professional traders. OptionsSwing also provides many educational resources, such as e-books and videos. They also offer live trading virtual classrooms of approximately 60-80 students Monday through Friday, three times per month. They offer these courses for both beginning and intermediate investors.

Swing and a hit

As the COVID-19 pandemic ravaged the stock market in March 2020, OptionsSwing found tremendous growth in difficult times as everyday investors flocked to the down market. This growth fueled the need to limit risk by automating the acceptance of a Terms and Conditions agreement for new subscribers to begin their investment educational journey. The Terms and Conditions agreement that all new OptionsSwing subscribers must sign includes information about understanding and accepting investment risk and acknowledging that they are not a licensed financial advisor.

Enter Docusign. OptionsSwing selected Docusign for its Click solution, which enabled it to not only capture consent of the agreement with a single click, but easily incorporate the technology into its website in only a few minutes. Prior to integrating Docusign Click into its website, OptionsSwing had a homegrown clickwrap system that was difficult to manage and maintain, so they were looking for a prebuilt, managed solution. With Docusign, not only is the Terms and Conditions agreement legally binding, but OptionsSwing wanted to ensure the platform managing the agreement was legally compliant, with features such as an audit trail that can prove the user accepted the agreement. Docusign Click lets you upload your document and set properties that determine the behavior of the agreement. This is all displayed to the user as a package known as a clickwrap.

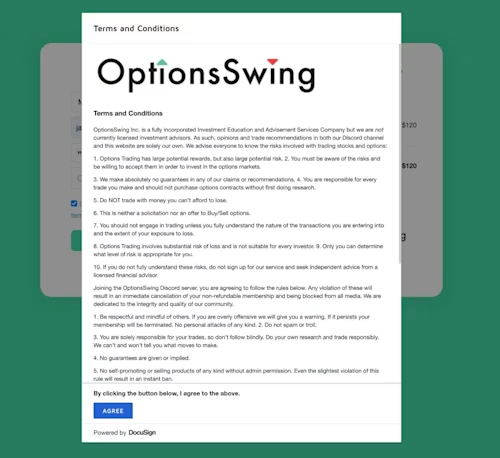

The OptionsSwing subscription signup workflow is simple, but powerful. A user navigates to the OptionsSwing site, reviews the available plans, and selects the plan they prefer to start the signup process. After entering an email address (which is used as a unique identifier for each user) and credit card information, the user immediately sees the rendered clickwrap on the screen, as shown in Figure 1.

Figure 1: Displaying a Docusign clickwrap to the user.

If the user agrees to the Terms and Conditions, their credit card is charged and an account is created. If the user does not agree, the signup process terminates.

How it works

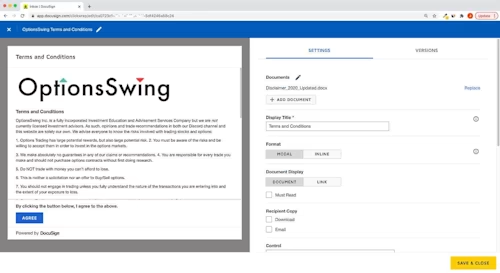

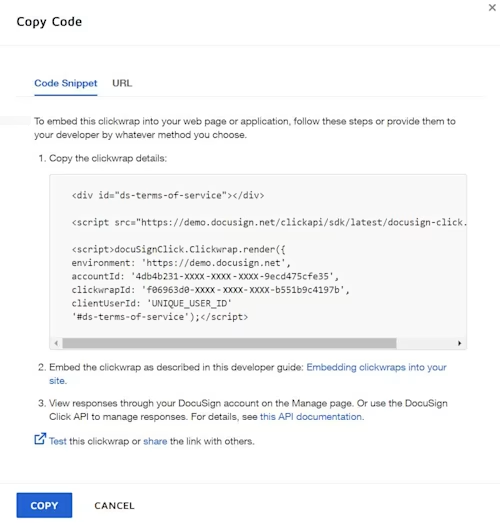

With Docusign Click, OptionsSwing was able to upload their Terms of Conditions (see Figure 2), using the Docusign app, set the desired properties for the behavior of the clickwrap, then receive personalized JavaScript code (see Figure 3) to place into their website to incorporate into their signup workflow.

Figure 2: Uploading an agreement to the Docusign Click site.

Figure 3: Personalized Docusign Click code snippet.

After OptionsSwing copied and pasted the personalized code snippet into their website, they had to code two additional things:

Dynamically replace UNIQUE_USER_ID with the user’s entered email address. This serves as a unique identifier as part of the OptionsSwing signup workflow. Based on the UNIQUE_USER_ID value, Docusign Click tracks not only which users have accepted the agreement, but what specific version of the agreement. Tracking based on a unique identifier enables OptionsSwing to simply upload a new version of the agreement, if applicable, and Docusign will automatically enforce accepting the new agreement if the clickwrap is configured accordingly.

Incorporate the clickwrap code into their workflow such that the credit card is charged only if the user accepts the clickwrap and exits if not. To charge credit cards, OptionsSwing incorporated a credit card processing API for a seamless end-user signup and payment experience.

Quick and easy

To understand how to develop their solution, OptionsSwing visited the Click API section of the Docusign Developer Center site and created a free Developer Account. The Developer Center is the single destination to learn how to integrate Docusign APIs into apps and websites. By following the examples and tutorials on the site, a single OptionsSwing developer was able to develop and integrate Docusign Click technology in only a couple of days.

One key thing that enabled quick and easy implementation was the ability for OptionsSwing to collaborate with their legal team on the Terms and Conditions Microsoft Word document, then simply upload it to create the clickwrap. Docusign even has a clickwrap tester that enables OptionsSwing to verify the functionality of the clickwrap before promoting it to a live state.

Collecting a premium for their options

OptionsSwing saw an immediate return on their investment (ROI). At the time they implemented their Click solution, they were thinking mostly in terms of reducing their legal risk by having a way to legally prove a user accepted the Terms and Conditions if they were challenged and less about financial ROI. However, OptionsSwing was able to achieve an unforeseen financial benefit: much higher favorable resolution on credit card charge disputes.

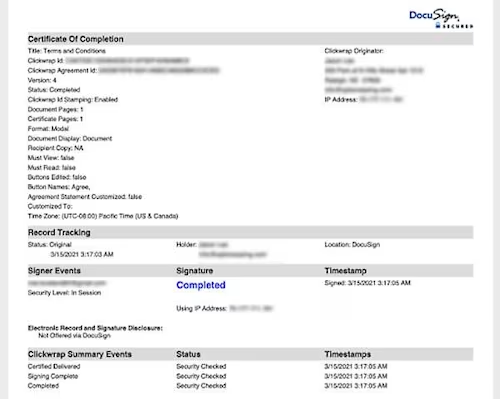

Prior to implementing Docusign Click technology, with their homegrown solution, when a subscriber challenged the validity of a credit card charge, OptionsSwing almost always lost the dispute with the credit card processor. They provided screenshots as evidence, but this wasn’t enough for the credit card processor to rule in their favor. After implementing Docusign Click, OptionsSwing was now able to provide an audit trail of evidence, known as a Certificate of Completion (see Figure 4). OptionsSwing now prevails in most cases that are challenged.

Figure 4: Sample Certificate of Completion.

OptionsSwing started with a Terms and Conditions agreement, but is looking to expand past this single use case. Especially as the economy reopens and in-person meetups become possible, they will be looking at sign-ups, waivers, and other types of agreements. They are also in the process of forming another company in the Software as a Service (SaaS) space.

You can experience the power and flexibility of the Docusign APIs for yourself. Visit the Docusign Developer Center to create your free developer account, and don’t forget to check out the Docusign Click API section of the site.

Additional resources

Tony Mann has been with Docusign since 2016, helping developers integrate Docusign into their apps. He is a published author and an expert SQL developer with a passion for developer education.

Related posts

Docusign IAM is the agreement platform your business needs