Docusign for Financial Services

Modernize financial services with digital agreements

Many of the most important moments in financial services rely on agreements, from opening an account to securing a loan or transferring wealth. Streamline these processes with digital agreements & deliver smarter, easier, and trusted experiences to customers.

Advance your goals

Delight customers and optimize experiences

Read Solution BriefMeet your customers where they are with frictionless, multi-channel signing experiences.

Bolster security and compliance efforts

Read Solution BriefSecurely scale digital agreements with tools for enhanced control, KYC/AML support and record-keeping.

Accelerate and automate processes

Learn About CLM+Simplify document workflows and seamlessly integrate digital agreements into your other systems.

How you can use Docusign

Docusign solutions help accelerate key business processes for all types of financial institutions:

Retail banks and lenders

Commercial and corporate banking groups

Wealth and asset management firms

Non-bank lenders

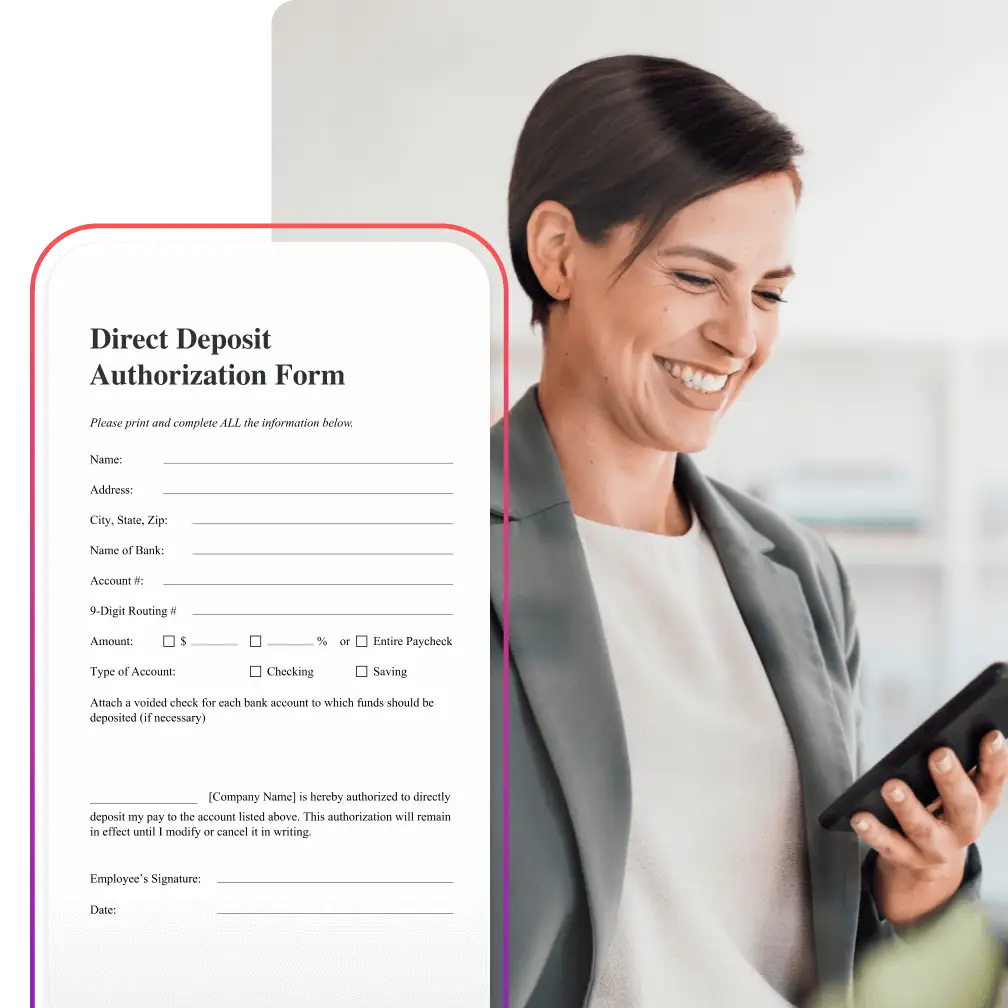

Retail account opening

Streamline onboarding paperwork and KYC/AML compliance with electronic signing and embedded identity verification.

Retail lending

Book interest revenue faster with simplified applications, remote online notarization and electronic vaulting.

Commercial financing

Eliminate tedious document preparation and reviews with workflow tools and integrations.

Branch services

Uplevel in-branch experiences with seamless signing on both bank-owned and customer devices.

Treasury management

Onboard business customers faster with streamlined document generation, review, and negotiations of services agreements.

QFCs and trading agreements

Simplify review and negotiations of ISDA documentation and reduce data processing costs.

Investor onboarding

Deliver a single envelope onboarding experience that consolidates IMAs, disclosures, custodian forms and more.

Account servicing

Delight customers with secure self-service for basic requests throughout their lifecycle.

Procurement

Expedite third-party contract negotiations and leverage AI to assess risks.

Ready to modernize your processes?

How FineMark saved hours and improved their workflows

How financial services organizations use Docusign

- Santander

Expedited account openings for commercial customers by 83%

"If we remove 30% of the time required to negotiate and execute a loan...that time gets channeled back into customer relationships."

Jonathan Holman

Head of Digital Transformation

- Trustmark

Reduced service turnaround time by 3 days.

"We needed a solution with great integration capabilities, and [Docusign CLM] had that."

Josh Laird

Vice President of Retail Administration

- Visions Federal Credit Union

2x faster turnaround on agreements

00:00 - Washington State Employees Credit Union

100+ paper forms transformed into digital workflows

"We wanted to create a safe and easy experience for members, and Docusign helped us do that."

Tyler Baccus

Digital Systems Analyst

- Vestwell

>90% faster contract completion and 200 hourse of manual labor saved monthly

00:00 - GreenStone Farm Credit Services

Zero rekeying of data in loan documents

"We’ve digitized the whole lending process, which saves time and money, reduces risk and gets funds to our members faster."

Steve Junglas

EVP & Chief Information Officer

- Merriman Partners

75% increase in borrowers sending back signed packets

"If you use Docusign to send out a document, it’s going to come back error-free."

Scott Rothman

Client Service Manager

eSignature for financial services

Securely send and sign agreements from virtually anywhere and any device while maintaining a detailed audit trail.

Additional Docusign products for financial services

Identify

Protect access to agreements with enhanced methods for authentication and verification.

Notary

Notarize documents remotely and electronically via a secure audio-visual session.

CLM

Accelerate contracting with tools supporting document generation, negotiation, storage and analytics.

Featured integrations for financial services

Recommended for you

6 Financial Services Trends to Watch

Learn about six trends shaping digital transformation priorities in financial services today and where digital agreements fit in.

Accelerate Time to Revenue with Smarter Contract Management

Learn how you can drive permanent process improvements at your financial services organization.

Experience it for yourself

Make your business faster, simpler and more cost-efficient with electronic agreements.

Contact sales

Our team would love to help you find the perfect fit of products and solutions.