Embrace the Digital Revolution: new tech tax cuts with the Technology Investment Boost

Small businesses can supercharge their digital capability with $1 billion in tax breaks from the federal government.

- It’s a great time for small business owners across Australia, with the Federal Government announcing the ‘Technology Investment Boost’ in the 2022 Federal budget - an additional $1 billion in tax breaks available to help turbo-charge digital transformation.

Table of contents

- It’s a great time for small business owners across Australia, with the Federal Government announcing the ‘Technology Investment Boost’ in the 2022 Federal budget - an additional $1 billion in tax breaks available to help turbo-charge digital transformation.

It’s a great time for small business owners across Australia, with the Federal Government announcing the ‘Technology Investment Boost’ in the 2022 Federal budget - an additional $1 billion in tax breaks available to help turbo-charge digital transformation.

In a move to help small businesses ‘embrace the digital revolution’ as quoted by Treasurer Josh Frydenberg, small business owners will now be able to claim $120 for every $100 spent on technology.

The investment in digital technology spans a large range of software and tools, including:

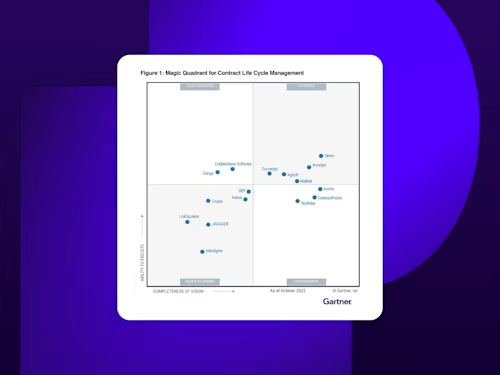

Cloud-based software like Docusign eSignature and Contract Lifecycle Management

E-invoicing like Docusign Payments

Cyber security software like Docusign Monitor for threat protection

Portable payment machines

Web design

More than 3.6 million small businesses with an annual turnover of less than $50 million will be able to claim a bonus 20 per cent deduction for the cost of expenses and depreciating assets, up to $100,000 of expenditure per year.

Dan Bognar, Group Vice President and General Manager of Docusign Asia Pacific & Japan, said: “As we move towards an ‘anywhere economy’ where customers and employees conduct business from literally anywhere, it’s fantastic to see the Federal Government providing support to small businesses across Australia to fuel their digital adoption.”

“By leveraging Docusign’s Agreement Cloud, small businesses can save time, money and help to protect the environment by digitising existing manual and paper based processes. With over 400+ integrations, our solutions can be embedded into the systems that a business is already using”.

“These tax breaks will help small businesses across the country to not only be more accessible, but do business faster, more efficiently, more securely - and provide a better customer and employee experience through the use of cloud based software.”

The boost will apply to expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2023.

With this announcement, there’s never been a better time to learn more about what the Docusign Agreement Cloud can do for your business. Contact sales today to learn more.

Docusign IAM is the agreement platform your business needs