Meeting the additional security needs of financial services institutions

The Finserv industry has strict security requirements. See how Docusign’s Solution Engineers help deliver the benefits of eSignature while meeting these needs.

This article is part of our series exploring how organisations solve specific problems with help from Docusign’s solution engineers. Here, Docusign Solution Architect Neal Woo shares a timely example of how Docusign can help boost security in the financial services industry.

As recent events in the telecommunications industry have shown, no organisation is immune to cyberattack. And those who are attacked can suffer costly reputational damage. The Optus saga has shone a new light on the need for watertight security in every aspect of an organisation’s digital dealings.

Well before the Optus data breach played out, Docusign was busy working with a major bank in Singapore to help shore up the security of its agreement processes. The bank operates in the highly-regulated financial services industry. Rules in this industry dictate that the company must control customer-related information on-premise, locally manage encryption keys, and monitor the event logs of application usage in real-time.

For this bank, these rigorous security protocols were holding them back from realising the full benefits of digital agreements. So they turned to Docusign for help in delivering a solution.

Docusign’s Security Appliance and Monitor address security issues

With its additional security features, Docusign eSignature is a preferred solution for financial services institutions. These security features include:

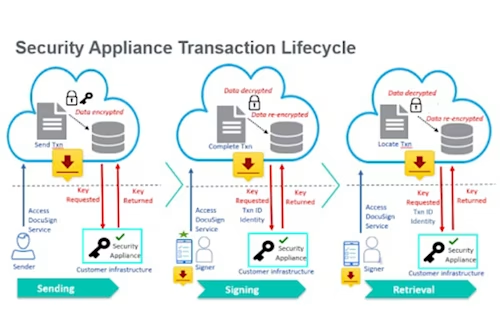

Docusign Security Appliance – a self-managing software appliance designed to address the needs of organisations that require the highest level of security, by allowing customers to manage the creation and custody of their document encryption keys (as illustrated in the diagram below).

Docusign Monitor – with round-the-clock activity tracking, Monitor protects organisations’ agreements by detecting potential threats in near real-time, investigates incidents with in-depth data, and responds fast. The tool can track over 40 events relating to user access, permissions and envelope activity.

Solving our customer’s specific security requirements

For this particular bank, they use a Hardware Security Module (HSM) to store and manage all of their encryption and decryption keys. To ensure they retain full control over their data and keep the management of keys on-premises, we proposed the integration of Security Appliance to their HSM.

Additionally, their security team mandated that the solution should be able to provide real-time logs of any potential malicious activities while the eSignature platform was being used – such as the deletion of documents (i.e. malicious employee), the mass download of documents (i.e. employee leaving with digital assets), or multiple logins from a list of countries that are not approved by the company (i.e. brute force attacks). Docusign Monitor provided the ideal fit here.

Overall, we were able to support the bank’s strict security requirements while delivering the benefits of the Docusign eSignature solution.

To learn more about how Docusign’s Solution Engineering team can support the specific requirements of different organisations and industries, get in touch today.

Docusign IAM is the agreement platform your business needs