Receipt template

A receipt is a formal document provided by a business to a customer as a record and acknowledgement of a transaction and proof that payment has been received.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated 23 Jan 2026

- Created by Docusign

Free Docusign Receipt Template

Use this free receipt template to ensure you provide your customers with professional proof of purchase for all transactions in Australia. Under Australian Consumer Law, businesses must provide a payment receipt template or other proof of transaction for any goods or services that cost $75 or more.

Docusign's cash receipt template is easily customisable for any transaction type, whether the customer pays with cash, credit card, or bank transfer. Once you have completed the receipt, you can securely send the document via a Docusign envelope to the recipient who needs to retain the proof of purchase. The completed record is securely stored in your Docusign account, and you can still download and print out a hard copy if needed.

Overview

A receipt serves as vital proof of transaction for both the seller and the buyer. For the customer, a receipt is often required when seeking a refund, repair, or replacement under Australian Consumer Guarantees. For the business, it's essential for accurately tracking sales, recording revenue, and maintaining compliant financial records.

The key distinction in Australia is between a 'Receipt' and a 'Tax Invoice'. A standard receipt is a proof of purchase. A Tax Invoice is only issued by businesses registered for the Goods and Services Tax (GST) and must explicitly show the GST amount.

For transactions under $75, an Australian business must still provide a receipt free of charge within seven days if the customer requests one.

Who It's For

This receipt template is designed for a broad range of Australian businesses, sole traders, and individuals who need to formally document the full or partial payment received for a sale.

The template is highly beneficial for:

Retail Businesses and Service Providers: For documenting all sales, including those paid for in cash, ensuring the customer receives valid proof of purchase as required by law.

Sole Traders and Freelancers: To provide a simple, professional record of payment that is particularly useful if the transaction is under the GST registration threshold.

Any Business Requiring Proof of Payment: To issue a reliable acknowledgment that the financial transaction is complete and the buyer has no remaining balance due.

Purpose of the Agreement

The primary purpose of the receipt is to acknowledge the successful completion of a transaction and confirm the payment has been fully received. By detailing the transaction, the receipt serves as:

Proof of Purchase: It is the key document a customer uses to prove they bought goods or services from your business, which is essential for warranty claims, refunds, or exchanges under the Australian Consumer Law.

A Record of Financial Exchange: It provides verifiable and itemised details of the sale for both the seller's and buyer's record-keeping, which is necessary for tax and accounting purposes.

An Acknowledgment of Terms: It documents the goods or services supplied, their price, and the date of supply.

Key Clauses and Information

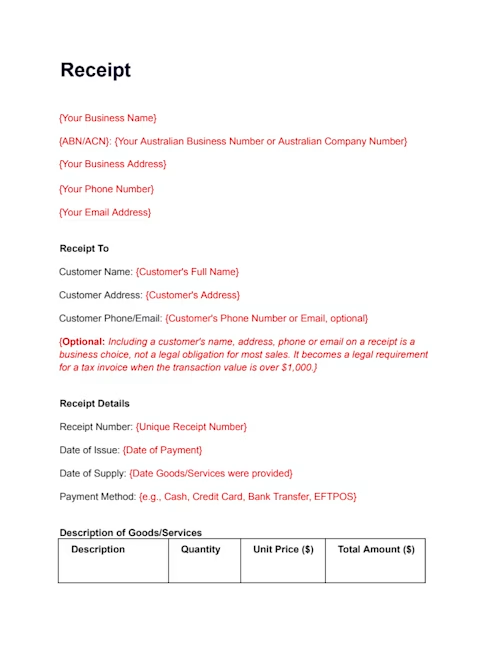

To be a valid proof of transaction in Australia, the receipt template includes the following information:

Title: Clearly titled "Receipt".

Business Details: Your business name and either your Australian Business Number (ABN) or Australian Company Number (ACN).

Receipt Details: A unique Receipt Number and the Date of Issue (Date of Payment).

Supply Date: The date the goods or services were actually provided.

Itemised Goods/Services: A clear description, quantity, and unit price of the items supplied.

Price: The price of the goods or services and the Total Amount Paid.

Payment Method: Details of how the customer paid (e.g., Cash, Credit Card, EFTPOS).

GST Statement (If Applicable): If your business is GST-registered, the receipt may include a GST line, or, for transactions over $82.50 (including GST), it should be titled "Tax Invoice" to allow the customer to claim a GST credit.

Total Amount Paid: The final amount, clearly showing the transaction is complete.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal advice and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is", "with all faults" and "as available" basis. To the extent permitted by law, the provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement. Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates. Notwithstanding the above, nothing in this disclaimer is intended to exclude or limit any rights that cannot be excluded under Australian law, including the Australian Consumer Law.

Create a free account to start using this Docusign template now