Payslip template

A payslip is a mandatory written record provided by an employer to an employee that details their pay for a specific pay period.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated 27 Jan 2026

- Created by Docusign

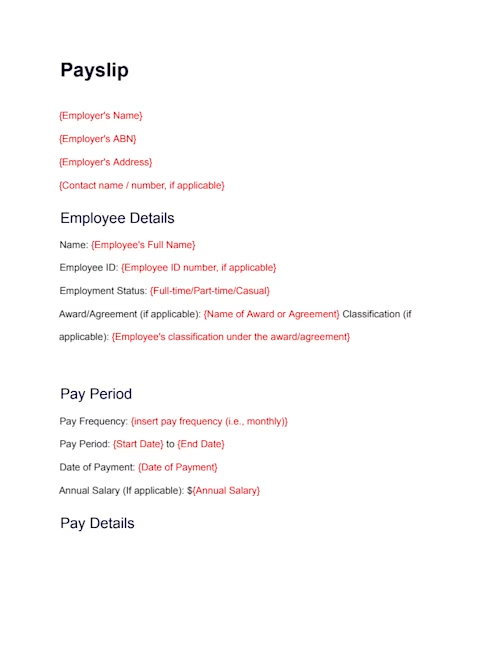

Free Docusign Payslip Template

Use this free payslip template to easily and accurately generate a legally compliant record of wages and deductions for your Australian employees. As an employer, you are legally required under the Fair Work Act 2009 to provide a payslip to your employees within one working day of their payday.

Docusign's free payslip template is professional, customisable, and designed to meet Australian best practices, saving you time and ensuring consistency. Once the payslip is completed with the employee's payroll information, you can securely share the document via a Docusign envelope to the recipient. After the document is sent, you’ll be able to securely access the completed record in your Docusign account, and you can still download and print a hard copy if needed.

Overview

In Australia, the payslip is a crucial document that provides a transparent breakdown of an employee's earnings, including the total wages paid, tax withheld, deductions, and superannuation contributions. Under the Fair Work Act 2009 and its Regulations, employers must issue a payslip every time an employee is paid, whether electronically or in hard copy.

The purpose of the payslip is two-fold: it informs the employee of their pay and entitlements, and it helps the employer maintain accurate and complete records for tax purposes and compliance with the Fair Work Ombudsman. Payslips must be legible, in English, and securely provided to the employee to maintain privacy. Failure to provide compliant payslips can result in fines and penalties.

Who It's For

This payslip template is designed for any Australian business, regardless of size, that employs staff under a modern award, enterprise agreement, or common law contract.

The template is essential for:

Employers and Small Businesses (SMEs): To fulfil their legal obligation to provide a written, itemised record of pay for all full-time, part-time, and casual employees.

Payroll Administrators: To standardise the process of calculating and documenting gross pay, deductions, and net pay.

Employees: As a mandatory document proving their income, tax paid (PAYG withholding), and superannuation contributions, which is often required for loans, rental applications, and other financial services.

Purpose of the Agreement

The payslip serves as a mandatory, formal record of a financial transaction between an employer and an employee for a specific period of work. Its primary purposes are to:

Ensure Compliance: Meet the legal requirements of the Fair Work Act 2009 by providing specific, detailed information about an employee's pay.

Provide Transparency: Clearly show how the gross pay was calculated, including hours, rates, allowances, loadings, and separate line items for all payments received.

Document Deductions and Tax: Itemise and explain all deductions taken from the gross pay, such as Income Tax (PAYG Withholding) and salary sacrifice amounts, while detailing where those funds were paid.

Verify Superannuation: Detail the amount of superannuation contributions made or intended to be made for the pay period, including the name of the superannuation fund.

Key Clauses and Information

Under the Fair Work Act, a payslip must contain specific information. The Docusign free payslip template includes the following key fields and sections:

Employer and Employee Details: The employer's name, Australian Business Number (ABN) (if applicable), and the employee's name.

Pay Period: The pay period date range and the date the payment was made.

Gross and Net Pay: The total amount of pay before tax and deductions (Gross Pay) and the final amount paid to the employee (Net Pay).

Hourly Employees: The ordinary hourly pay rate, the number of hours worked at that rate, and the total dollar amount paid at that rate.

Salary Employees: The annual rate of pay (salary) as at the last day of the pay period.

Separate Entitlements: Itemised amounts for any loadings (like casual loading), overtime, allowances, bonuses, incentive-based payments, and penalty rates.

Deductions: The amount and details of all deductions from the gross pay, including income tax (PAYG Withholding) and the name, or name and number, of the fund or account the deduction was paid into.

Superannuation: The amount of superannuation contributions made or intended to be made during the pay period and the name and number of the superannuation fund.

Payment Method: Details of the bank account where the net pay was deposited.

Leave Balances (Best Practice): Although not legally required, it is considered best practice to include leave balances, such as Annual Leave and Personal/Carer's Leave.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal advice and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is", "with all faults" and "as available" basis. To the extent permitted by law, the provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement. Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates. Notwithstanding the above, nothing in this disclaimer is intended to exclude or limit any rights that cannot be excluded under Australian law, including the Australian Consumer Law.

Create a free account to start using this Docusign template now