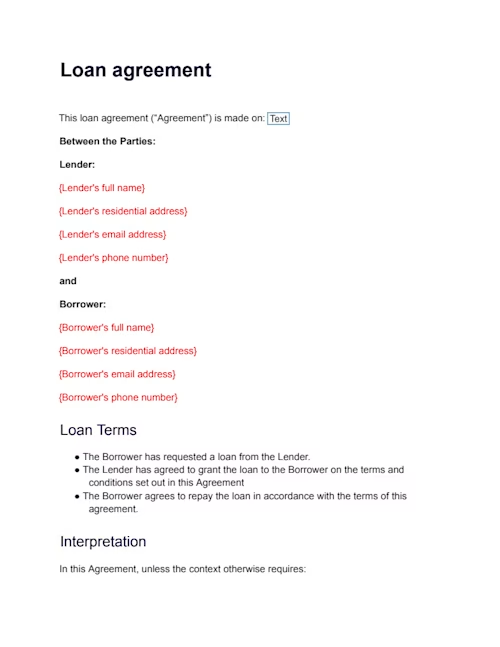

Loan agreement template

A Loan agreement is a formal, legally binding contract between a lender and a borrower that sets out the principal amount, interest, repayment schedule, and all other terms under which money is provided.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated 23 Jan 2026

- Created by Docusign

Free Docusign Loan Agreement Contract Template

Use this free loan agreement contract template to formally document the terms of a loan, which is essential for protecting both the lender and the borrower in Australia. A written agreement provides clarity that the money is a loan and not a gift, and it avoids disputes by setting clear terms for repayment.

Docusign's loan agreement template is easily customisable to suit various commercial or private lending scenarios, including options for interest-free loans, lump sum repayments, or installment plans. Once the agreement is complete, you can securely share the document via a Docusign envelope to both the borrower and the lender for their electronic signatures. The executed agreement is securely stored in your Docusign account for record-keeping, downloading, or printing.

Overview

A loan agreement is a crucial legal document that sets the framework for a debt relationship. While verbal loan contracts may be binding in Australia under certain circumstances, a written agreement is highly recommended to clearly document all terms, which is much easier and less costly to enforce should a dispute arise.

A vital consideration in Australia is the National Credit Code (NCC). This template is designed for commercial or business loans and not for personal, domestic, or household purposes. If the loan is provided to an individual or strata corporation predominantly for personal, domestic, or household use, and the credit provider is in the business of lending, the loan would likely be covered by the NCC. The NCC imposes significant regulatory and disclosure requirements on the lender, which are not covered by this simple template.

The agreement details the core financials, including the principal Loan Amount, the Interest rate (if applicable), and the Repayment schedule, providing both parties with financial certainty.

Who It's For

This borrowing contract template is primarily designed for:

Businesses or Companies: To formally document lending money to or borrowing money from another entity, shareholder, director, or employee for a business purpose.

Individuals in Commercial Transactions: To document private loans between individuals, provided the loan is for a non-consumer (i.e., commercial or business) purpose.

Private Lenders: To establish clear, enforceable terms and conditions when advancing capital.

Note: If the loan is for personal or household purposes and involves an interest charge, you should seek legal advice to ensure compliance with the Australian National Credit Code.

Purpose of the Agreement

The primary purpose of the loan agreement template is to define the terms of the debt to ensure both parties understand their rights and obligations. By doing so, the agreement serves to:

Document the Debt: It provides clear, legally enforceable proof that the money transferred is a loan with an expectation of repayment, and not a gift.

Mitigate Risk for the Lender: It sets out what happens in the event of default, including the right to demand immediate repayment and charge penalty interest on overdue amounts.

Define Financial Terms: It fixes the Loan Amount, the Interest rate and compounding frequency, and the specific Repayment schedule (installments or lump sum), preventing ambiguity.

Establish Security (Optional): It provides a framework to register a security interest over assets (collateral) on the Personal Property Securities Register (PPSR), if applicable.

Key Clauses and Information

A legally comprehensive Loan agreement in Australia includes the following clauses and information:

Parties and Loan Amount: Full details of the Lender and Borrower, and the precise principal Loan Amount in AUD.

Purpose of the Loan: A statement confirming the loan is for a commercial or business purpose to declare that it is not a 'credit contract' under the National Credit Code.

Repayment Terms: Specifies whether the loan will be repaid in regular Installments or as a single Lump Sum Repayment on or before the final due date.

Interest: Must specify the annual Interest rate (if any) and how it will be calculated (e.g., daily, monthly) on the outstanding balance.

Method of Repayment: The agreed method, such as a Bank Transfer, along with the Lender's bank account details (Bank Name, BSB, Account Number).

Security (Optional): If applicable, a clause granting the Lender a security interest over specific property and the Borrower's agreement to register this interest on the PPSR.

Default and Late Payments: Defines what constitutes a default (e.g., failure to make a payment), the Lender's right to accelerate the loan (demand full repayment immediately), and the application of a Penalty interest rate on overdue amounts.

Costs: Borrower's liability for the Lender's reasonable enforcement costs (e.g., legal fees) in case of a default.

Governing Law: The State or Territory whose laws will govern the agreement.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal advice and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is", "with all faults" and "as available" basis. To the extent permitted by law, the provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement. Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates. Notwithstanding the above, nothing in this disclaimer is intended to exclude or limit any rights that cannot be excluded under Australian law, including the Australian Consumer Law.

Create a free account to start using this Docusign template now