Seamlessly Deliver Personalised Signing Experiences with Elastic Signing

Elastic Signing enables you to deliver embedded agreements that elastically fit into your existing website or app and give signers a personalised experience.

Table of contents

Digital experiences are now the norm. Personally and professionally, we're constantly using digital devices and apps to conduct the business of life. We've come to expect their convenience. But, when consumers and companies interact digitally, any negative experience can have an outsized, negative impact on customer experience, brand loyalty and, ultimately, revenue.

We've all experienced it. You're mostly finished filling out an online application when you're presented with an agreement embedded within the site, and then you have to reenter some or all of the same information again. And sometimes that embedded agreement looks nothing like the original application's branding, so you start doubting its authenticity and security. It's frustrating and frightening, and there are just too many options out there for consumers to stick around for these types of inconveniences.

Providing digital experiences is no longer optional—but companies must ensure those interactions are seamless and frictionless to prevent abandonment and keep customers happy.

Create personalised signing experiences with Elastic Signing

Docusign now offers Elastic Signing within eSignature. Deliver embedded agreements that elastically fit into your existing website or app, and give signers a seamless, personalised experience within loan applications, account sign-ups, buy-now-pay-later terms acceptance, and more.

For customers, Elastic Signing elevates the signer experience through:

Agreements embedded directly into websites or applications, with customised UI elements such as fonts, background, and the color and spacing of borders and buttons—for a consistent brand look and feel.

Personalised agreements featuring dynamic content—like the signer's name, title and company. This information is populated responsively, matching the formatting of the document and saving the signer from having to input redundant details multiple times.

Simple, click-of-a-button signing that eliminates any extra steps that increase abandonment rates.

For companies, Elastic Signing improves agreement deployment and management by:

Leveraging conditional logic to automatically display or hide content based on various fields in the agreement. For example, admins can set up a rule that only shows certain terms based on the state in which the signer resides, allowing for easy deployment of agreements at scale and eliminating the need to manage multiple templates for similar documents.

Managing and updating agreement versions without additional coding, and full tracking of which versions have been signed.

Producing a Certificate of Completion that includes a copy of the signed agreement and a complete audit trail, aiding record-keeping and satisfying legal requirements.

Elastic Signing use cases

This new feature elevates the signing experience for all types of industries that need to embed agreements and contracts within their digital footprint. Compared to traditional PDF-based signing, Elastic Signing provides a completely unified look and feel between the agreement and the application for a smooth and cohesive interaction.

Across industries, companies can use Elastic Signing to deliver a fast and seamless, digital-first signing experience that delights users and increases completion rates:

Financial services: Loan applications, investment transactions

Insurance: Online insurance policy sales and applications

Retail: Agreement for buy-now-pay-later terms, affiliate sign-ups

Auto: Auto payment term agreements, auto-loan applications

Telco: Account opening, plan sign-ups

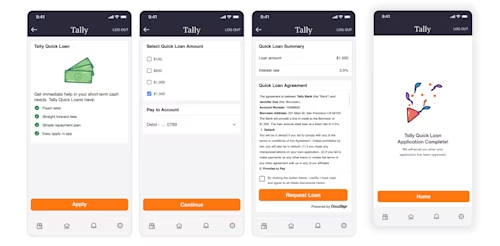

Let’s take a closer look. The example below shows how a Tally Bank customer can apply for a quick-cash loan directly from their online banking app.

Once a loan amount is selected, Elastic Signing displays an agreement directly within the app with design and formatting that matches Tally Bank’s look and feel.

The customer’s name, account number, and other loan information is dynamically inserted into a fully responsive document—eliminating the hassle of filling in details they’d already provided. And with conditional content, the agreement automatically shows location clauses that correspond to the customer’s home state.

Now, all the customer has to do is review the terms, agree to the conditions and click the Request Loan button to sign the agreement and submit the application. And that’s it: a quick and convenient transaction that’s easy to manage for the company and the consumer.

Elastic Signing is available in eSignature Enterprise Pro. Talk to your account manager today about using Elastic Signing to replace clunky agreement steps with a simple, seamless process that prevents premature abandonment and keeps customers happy.

Learn more about Docusign eSignature.

Related posts

Docusign IAM is the agreement platform your business needs