Digital Day recap: Streamlining financial services and delivering a best-in-class customer experience

Catch up this Digital Day session on how financial services companies can transform processes and delight customers by digitising agreements.

The inaugural APAC Digital Day 2022 is done and dusted. Here’s a recap of our session on how the financial services industry can deliver best-in-class customer experiences by automating and digitising processes – which in turn improves turnaround times, drives efficiency, and increases conversions and customer satisfaction, all while maintaining security and compliance.

In financial services, agreements are fundamental to the customer moments that matter. Opening an account. Securing a loan. Transferring wealth. In all these moments and more, customers want to interact on their terms – and, increasingly, they expect digital, frictionless, fast and easy experiences. Yet meeting these expectations while maintaining security and compliance can feel hard.

Last week’s Digital Day session on financial services shows how easy it can be to transform the customer experience while meeting rigorous internal requirements.

Indeed, across the financial services industry, stories are emerging of organisations that are embracing digital change on the quest to deliver better experiences. As Jennifer Lauchlan, Industry Lead - ANZ Financial Services at Docusign said, “My observation is that our customers have matured the way they use Docusign by integrating more heavily, and automating upstream and downstream for a truly end-to-end process. And greater automation and integration lead to even more cost savings, productivity, and the capacity to serve recent demand when it comes to customer experience.”

Why financial services companies choose Docusign

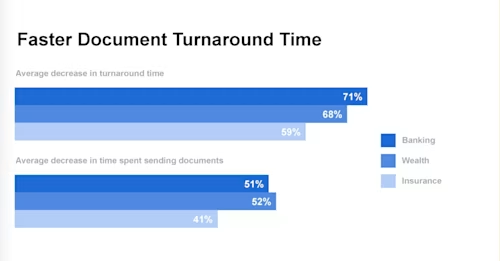

Jennifer shared some of the key findings of a recent survey on the top 10 reasons financial services decision-makers choose Docusign. According to the results, the top pain point was slow document turnaround times – which Docusign swiftly solved. In banking, for example, there was an average 71% decrease in document turnaround time, and a 51% decrease in the time spent sending documents.

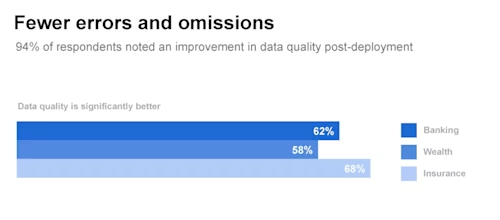

The second pain point was around errors and omissions in documents. With Docusign, 94% of respondents noted an improvement in data quality post-deployment; with 62% in banking saying data quality was significantly better.

And, most importantly, 71% realised an improvement in customer satisfaction with Docusign, which solved a key pain point in terms of attracting and retaining customers.

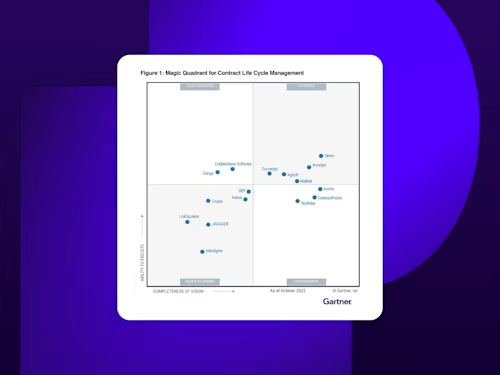

As all of these stats show, the benefits of implementing a digital transformation strategy like eSignature or contract lifecycle management simply can’t be ignored. And, as one bank’s pilot program proves, it gets great results.

A RAMS pilot proves the impact of Docusign

Jennifer was joined by Charles Aldridge, Head Of Customer Lending Experience, RAMS, who explained the rationale behind their pilot with Docusign. He also shared some phenomenal results.

As Charles said, home loan specialist RAMS exists to help Australians fulfil their dreams of home ownership. Anything they can do to streamline the process of applying for a loan and getting funds to customers is a big win – for both their customers and the business.

“My role is to consider any opportunity to improve the lending experience. When you overlay Docusign’s key attributes with RAMS’ broader strategy – to perform, simplify and fix – there is a broad alignment,” he said.

With this in mind, they have partnered with Docusign to build loan offer documents that enable customers to electronically accept a home loan – from anywhere, at any time, on any device. For customers, the change has been transformative. Charles shared the example of a Queensland customer whose finance had fallen through, and had just seven days until settlement. Using Docusign, new loan documents were prepared, sent and signed on the same day.

Indeed, the average home loan turnaround time has dropped from 12 days down to 2 days.

Internally, the benefits range from a boost in productivity to reduced operational costs. They have eliminated errors from the home loan process, turning a time-consuming and error-ridden process into something fast, intuitive and easy to navigate. Key results include:

30% reduction in operational costs

70% reduction in mail and courier costs

8-10% boost to productivity

1 million sheets of paper saved per annum

The RAMS story is a great example of how one simple change can have a huge impact on the customer experience and the bottom line.

You can read more about the transformative impact of Docusign at RAMS in this customer story, or jump back into the webinar to hear more from Charles. Or, to discuss the benefits of digital agreements in your financial services organisation, get in touch for a no-obligation chat.

Related posts

Docusign IAM is the agreement platform your business needs