Accountants: Send and Receive T183 Forms with eSignature in ProFile

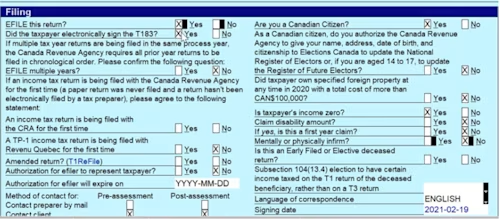

Canadian tax accountants using Intuit Profile use eSignature to electronically sign T183 forms to reduce reliance on paper and improve efficiency.

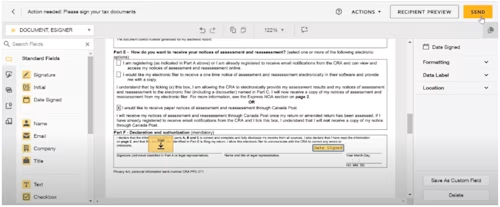

Even if your organization is using ProFile to manage your business, you’ve likely been frustrated by the wait time for wet signatures and manual nature of the workflow processes. In particular, when the tasks associated with preparing T183 forms for signature are manual, they take time away from the core mission of serving customers efficiently. Now you can easily and securely accelerate signature requests, collection, and payments by using Docusign eSignature directly from your ProFile tax return software.

Improve Client Experience

Clients expect modern digital experiences when working with businesses of all sizes. By leveraging eSignature, your clients can easily electronically sign, date, and return documents within minutes. With Docusign eSignature, 82% of all agreements are completed in less than 24 hours and average signing turnaround time is reduced by more than 80% versus paper signing processes.

Save Paper and Money

Docusign eSignature for ProFile can help your firm go paperless and save on the costs associated with printing, shredding, and mailing. Not only will you be helping the environment by decreasing your carbon footprint, you will also help your bottom line. Docusign eSignature saves an average of $51 CDN per document compared to traditional paper processing.

Keep Data Safe and Secure

Electronic Signature has been recognized by law in Canada for over 20 years, is court-admissible, and may be used for the majority of general business transactions. Docusign meets some of the most stringent global security standards such as SOC1, SOC2, ISO 27001: 2013 and PCI DSS. For Accountants, eSignature is available for T1 Personal Tax forms T183 and T183CORP and Auth Rep, plus additional forms cross T1, T2, T3, and FX modules.

Improve Process Efficiency and Streamline Workflows

Accountants today frequently use multiple apps to run their business, often having to duplicate work to keep the systems in sync. By leveraging eSignature within ProFile, you can request digital signatures on multiple forms and documents from multiple parties in a single request folder. Docusign eSignature automates an audit trail every step of the way, and lets accountants manage requests, delivery, and signature statuses of client returns from one central dashboard.

Ready to connect to Docusign eSignatures and collect signatures in ProFile? Join the tens of thousands of customers sending millions of eSignature transactions a year in Canada alone.

Learn more about Docusign eSignature for Quickbooks ProFile!

Related posts

Docusign IAM is the agreement platform your business needs