Digital ID Verification of Government-Issued IDs

Docusign ID Verification is a digital, mobile-friendly way to verify a signer’s identity using a government-issued photo ID.

Electronic signature technology has made it possible for hundreds of millions of people in over 180 countries to legally sign contracts and other agreements on practically any device, from almost anywhere, at any time. For most agreements, a person simply clicks a link in an email to review and sign the document; access to the email account is sufficient proof of identity.

But if you’ve ever opened a bank account or applied for a loan, you know that those high-value, high-risk business agreements often require stronger verification of identity to prevent fraud. Unfortunately, that usually involves walking into an office and physically handing someone your passport or driver's license. While that may have been an inconvenience twenty, ten or even five years ago, today it’s a huge pain in the… agreement process.

In fact, that single, manual step in the agreement process—even if the rest of the process is completely automated—can be a deal-breaker for high-value customers you can’t afford to lose. So why risk it? Because you didn’t have any other choice? Well now you do, and a good one at that.

Introducing Docusign ID Verification

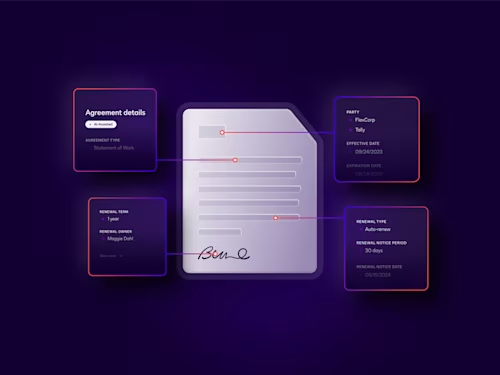

We’re excited to introduce Docusign ID Verification, the digital, mobile-friendly way to verify a signer’s identity using a government-issued photo ID. ID Verification is part of the Docusign Identify family of products, which includes phone, access code, SMS and knowledge-based authentication options, and now ID verification, for faster, easier and more secure completion of agreements.

More sensitive or higher-value agreements certainly warrant this extra step in the process. There’s simply more at stake. In some regions of the world, a stronger level of identification is a requirement for any digitally signed agreement to be considered legally enforceable. But sometimes, manually verifying an ID in person isn’t practical or possible. Digitally transforming this critical part of the agreement process—especially when the next step (signing) is already digital—not only makes sense but also makes business possible for more people. Compared to manual ID verification, Docusign ID Verification is equally secure but much more convenient.

ID Verification is the latest product released as part of our recently announced Docusign Agreement Cloud, which helps organizations digitally transform the way they do business via contracts and agreements through innovative applications, integrations and platform technologies. Below we highlight a few ways that Docusign ID Verification helps prevent fraud and improve compliance while improving the customer experience.

Deliver the digital speed and convenience customers expect

Speed and convenience ranked highest in recent research for what consumers value most in their customer experience. Manual identity verification is a slow, inconvenient process. Docusign ID Verification allows signers to quickly and easily verify their identity with a passport, driver’s license or national identity card by simply uploading a picture from their computer or using their mobile device to take and submit a photo of their document. It’s available 24/7, wherever and whenever signers find the time. No more making appointments or standing in line.

Alternatively, your company may have existing investments in other identity verification or authentication tools that customers already know and use, for example, to log in to a customer portal. In that case, you can leverage the Identity Platform’s open API to integrate these tools into the agreement workflow, so signers can identify themselves in familiar, convenient ways.

And, of course, Docusign ID Verification is fully integrated with Docusign eSignature, the world’s #1 way to sign electronically. Automating and connecting the identity verification process as part of the overall agreement workflow means even faster agreement completion and better customer experiences.

Reduce risk while increasing conversion rates

As your digital business grows, verifying the identity of signers becomes more important for both you and your customers. A 2018 report on global fraud found that the lack of visible security was the #1 reason customers abandoned an online transaction. ID Verification reduces business risk, builds customer confidence, and supports legal validity and compliance with regional regulations, such as Know Your Customer (KYC) in the US—and does it all automatically, with fewer errors than manual processes.

ID Verification works hard behind the scenes to ensure only valid identity documents are recognized. It analyzes alphanumeric data and other unique information contained in an identity document to check the document’s validity. Then, it ensures the name on the agreement matches that on the identity document, so only the correct individual can view the agreement. With ID Verification, you’re protecting not only your business but also the people being identified, and it shows.

Do business globally

ID Verification frees you to do business in countries where you may have no physical office, and it ensures agreements are legally enforceable and compliant with those regional identification processes. Currently, ID Verification supports government photo IDs from: US, UK, France, Germany and Canada. For businesses operating in the EU, we also support popular eID schemes such as BankID Sweden, BankID Norway, iDIN in the Netherlands, and Finnish Trust Networks in Finland. We are planning to quickly expand our coverage globally to support even more country-specific identification needs. Contact us, and we’ll keep you posted.

To help companies of all sizes compete at speed and scale in the EU, Docusign supports digital signatures and provides all signature types defined under eIDAS. ID Verification supports achieving eIDAS compliance at the Advanced signature level with the addition of Docusign Standards-Based Signatures.

Learn more about ID Verification and how the Docusign Identify product family allows you to configure almost any type of identification process into our signature workflows while reducing risk and delivering a better experience for customers.

Related posts

Docusign IAM is the agreement platform your business needs