3 Considerations for Implementing Transaction Management and Storage Solutions

Real estate transactions are complex, paper-driven, regulated processes that involve a diverse group of stakeholders and a high volume of documents.

Real estate transactions are complex, paper-driven, regulated processes that involve a diverse group of stakeholders and a high volume of documents. While the industry has widely adopted electronic signature to simplify contract signing, many brokerages still struggle to accelerate the entire transaction process and offer a better experience for all parties involved.

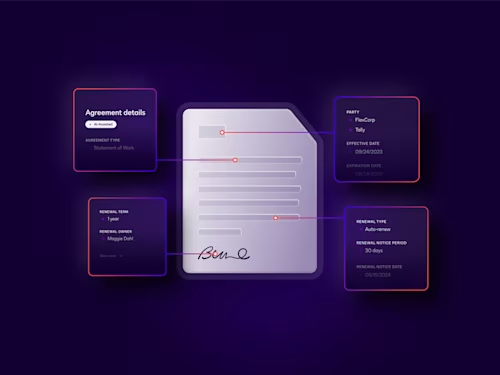

Real estate transaction management solutions create a secure, digital workspace for all the files involved in a real estate transaction. New technology allows you to customize the workspace to match the processes and workflow of your brokerage, increasing efficiency and supporting operational and financial growth goals. Automation provides brokers visibility into transactions in real-time so they can process more files, maintain accurate forecasts and free up time spent tracking down documents. It also provides pipeline visibility, supports compliance and keeps agents and clients satisfied which can lead to a better night’s sleep.

Here are three things to look for when choosing a transaction management and storage solution.

1. Alerts can help accelerate the process

A good automated transaction management system will highlight potential issues before they become hot. Flagging missed signatures, disclosure documents and financial documents should be a standard feature. Ultimately the system should enable brokers to process more complete, clean transactions more quickly, freeing up time for other Broker duties like agent recruiting and training.

2. Automated categorization and status reporting

Additionally, the system should categorize and save transaction documents for easy status checks and enable access, review and close. Not only does this save time tracking down documents to complete transaction files but it increases agent satisfaction by providing them with access to documents and their status. And the end of year statements for clients are only a few clicks away.

3. Secure and distributable access and storage

A long term document storage strategy should be part of an overall document compliance plan. Depending on the state where the brokerage is licensed, the required storage time can be from 3-6 years. IRS regulations require 7 years. Considering that your clients are for a lifetime and may call and request copies of transaction documents from engagements from years passed, having a long-term plan could prove beneficial.

A transaction management system needs to perform the heavy lifting you need. It should save time, provide insights into brokerage forecasts and support agent and client satisfaction. When creating document compliance policies include a long-term storage and retrieval system for times when you might need access to documents for legal or for client requests. It is better to be safe and rest assured, than to be sorry.

“This connection automatically and securely files, saves, stores and allows me to distribute the current or closed transaction documents for several offices that I manage. It is a big time saver and a relief that there is a copy of everything I need to be in compliance.” - Broker Operations Manager, FL

If you are a busy broker who is interested in an efficiency-creating, time-saving way to automate your transaction document storage, accessibility that supports compliance, connect your Docusign Rooms for Real Estate account to GoogleDrive using Apination today.

Related posts

Docusign IAM is the agreement platform your business needs