Payment Receipt template

A Payment Receipt is a critical business document issued after a payment has been made, serving as proof that a financial transaction for goods or services has been completed.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 23, 2026

- Created by Docusign

Free payment receipt template in Docusign

Docusign provides a free, customizable payment receipt template that you can use as a reliable receipt generator for your Canadian business transactions. This template allows you to quickly and professionally document that funds have been received, which is essential for accurate financial record-keeping and for providing proof of payment to your purchaser.

How to use the template: You can open the free template in your Docusign account or start a free Docusign trial to begin creating your receipts.

Editing the template: The template is fully editable, allowing you to personalize the details to suit your specific transaction. You can easily fill in the purchaser and supplier information, details of the goods or services, and payment particulars.

Sending and storing the receipt: Once you’ve completed the form, the receipt can be electronically signed, shared securely as a Docusign envelope, and is then securely stored in your Docusign account for easy access and record-keeping. You can also download and print a hard copy if needed.

Overview

A payment receipt is not an invoice (which is a request for payment), but rather the final document in a transaction, confirming that the money has been received. It is an essential component of professional financial administration, acting as an audit trail for your business and a record for your client. Utilizing a consistent receipt template helps your business look professional, reduces errors, and ensures that all necessary information, including tax details, is accurately documented.

Who it’s for

This versatile payment receipt template is designed for any business, freelancer, or individual in Canada who needs to issue an official acknowledgement of payment received. This includes:

Small and medium businesses (SMBs): To confirm customer payments for sales of goods or services.

Landlords: To provide tenants with a formal receipt for rent payments.

Contractors and freelancers: To document payment received after a job is complete or an invoice has been settled.

Any business operating in Canada that needs to provide proof of payment for tax and accounting purposes, especially when dealing with cash transactions where other proof may be limited.

Purpose of the document

The main purpose of a payment receipt template is to formally acknowledge that a monetary transaction has occurred and that the specified amount has been received by the supplier. In the Canadian context, this document is vital for:

Financial record-keeping: It serves as a source document to accurately record incoming revenue for accounting purposes and to manage cash flow.

Tax compliance: It provides the necessary records to support income declarations and to document the collection of applicable taxes like GST/HST and PST/QST.

Proof of payment: It gives the purchaser, or payer, a clear and undeniable record for their own expense tracking, warranties, returns, or for internal expense claims.

Dispute resolution: By detailing the amount, date, and goods or services, it helps prevent discrepancies and disagreements between the two parties.

Key clauses and information

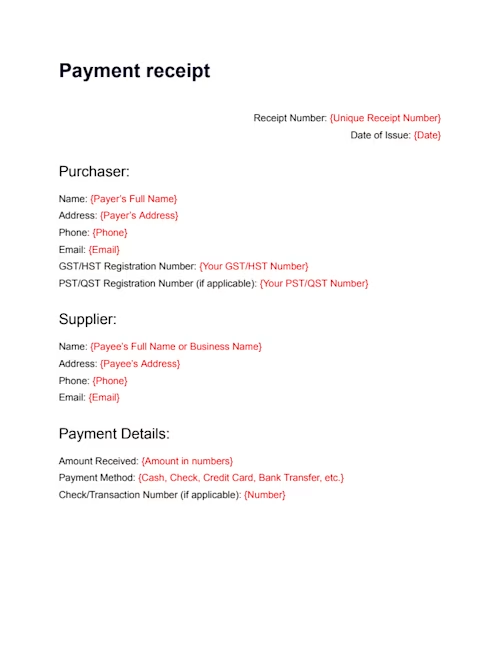

The payment receipt template is structured to include all the essential information required for a professional and legally compliant record of payment in Canada. When using this receipt generator, be sure to include the following key details:

Document title and receipt number: Clearly labelled as a “Payment receipt” with a unique, sequential number for internal tracking and easy referencing.

Supplier and purchaser information: Full names, addresses, phone numbers, and email addresses for both the payer (Purchaser) and the recipient (Supplier).

Date and tax registration: The date of issue and, if applicable, your business's Canadian GST/HST and PST/QST registration numbers.

Payment details: The exact amount received, the method of payment (e.g., Cash, Credit Card, Bank Transfer), and any relevant check or transaction number.

Itemized description of goods or services: A clear, itemized table outlining what the payment was for, including descriptions, quantities, unit prices, and line-item totals.

Payment summary: A breakdown including the subtotal, the amount of any applicable taxes (GST/HST and PST/QST), and the final total amount.

Balance information: If the payment is a partial payment, clearly indicate the amount due before payment, the amount paid, and any remaining balance.

Acknowledgement of receipt: A section for the Payee’s signature and printed name, confirming that the payment has been formally received.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates. The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Create a free account to start using this Docusign template now