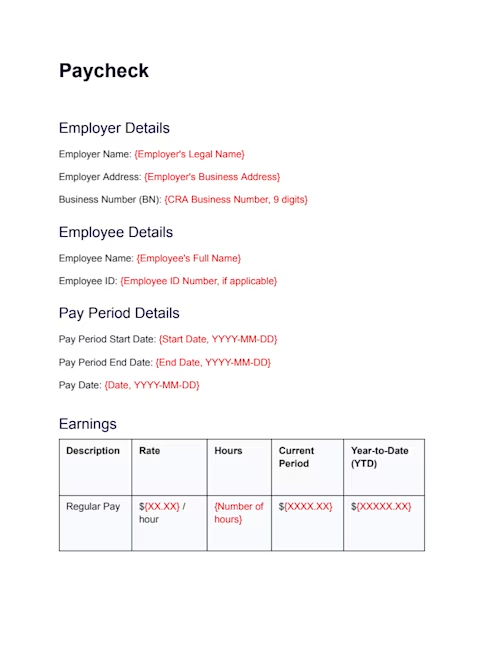

Paycheck template

A Paycheck (also known as a pay statement or pay stub) is a detailed, formal record provided by an employer to an employee, which breaks down the employee's earnings, deductions, and net pay for a specific pay period.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 23, 2026

- Created by Docusign

Free paycheck template in Docusign

Docusign provides a free, customizable paycheck template that Canadian employers can use to generate clear and comprehensive pay statements, often referred to as a paystub template. Using Docusign allows for accurate calculation, secure distribution, and professional record-keeping, essential for meeting provincial and territorial payroll requirements.

How to use the template: You can open the free template in your Docusign account or start a free Docusign trial to begin creating your pay statements.

Editing the template: The template is fully editable, allowing you to accurately input all details, including employee and employer information, hourly rates, hours worked, statutory deductions, and total earnings.

Sending and storing the pay stub: The completed pay stub can be shared securely with the employee as a Docusign envelope and is then securely stored in your Docusign account for your business records.

Overview

In Canada, providing employees with a detailed pay stub template (or its electronic equivalent) is a legal requirement in all jurisdictions. This document, sometimes called a paycheck pay stub template, ensures transparency regarding how an employee's gross earnings are calculated and what deductions (both statutory and voluntary) have been taken before they receive their net pay.

The pay statement is a fundamental financial record for the employee, allowing them to verify the accuracy of their pay and serving as crucial proof of income for applications such as mortgages or tenancy. For the employer, maintaining accurate pay statements is vital for compliance with the Canada Revenue Agency (CRA) regarding remittance of Income Tax, Canada Pension Plan (CPP), and Employment Insurance (EI).

Who it’s for

This paycheck template is designed for all employers operating in Canada who are legally required to provide a record of earnings and deductions to their employees. This includes:

Small and medium businesses (SMBs): To generate compliant and easy-to-read payroll documents.

HR and payroll departments: To standardize the process of providing pay statements across the organization.

Contractors or individuals who employ staff: To ensure they meet their legal obligations for tax and employment standards.

Purpose of the Document

The primary purpose of the paycheck pay stub template is to document the financial transaction between the employer and employee for a defined pay period. By clearly itemizing all financial components, it serves several critical functions:

Transparency and verification: It provides the employee with a clear breakdown of their total earnings and the mandatory and optional amounts deducted, allowing them to verify the correct pay was received.

Statutory compliance: It legally documents the remittance of required government deductions, including federal/provincial income tax, CPP/QPP, and EI/QPIP, as required by the CRA and Service Canada.

Year-to-date tracking: The document tracks both current period and year-to-date (YTD) amounts, which is essential for accurate year-end tax documentation like T4 slips.

Key Clauses and Information

A compliant Canadian paystub template must contain several mandatory fields to be legally valid. The Docusign template is structured to capture these details:

Employer and employee details: The legal name and address of the employer and the full name and ID (if applicable) of the employee.

Pay period and date: The specific start and end dates of the pay period and the official pay date.

Total gross earnings: An itemized breakdown of all pre-tax earnings, including regular pay, overtime pay, statutory holiday pay, and vacation pay.

Statutory deductions: Mandatory government deductions, which must include Federal/Provincial Income Tax, Canada Pension Plan (CPP), and Employment Insurance (EI). If the employee works in Quebec, it must include Quebec Pension Plan (QPP) and Quebec Parental Insurance Plan (QPIP) instead.

Other deductions: Any non-statutory deductions, such as health/dental benefits, company pension, or union dues.

Net pay: The final amount the employee receives after all deductions are subtracted from the gross earnings.

Accrued vacation balance: Information on the amount of vacation pay accrued for the current period and the total accrued balance.

Business number (BN): The employer's CRA Business Number

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates. The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Create a free account to start using this Docusign template now