Invoice template

An invoice is a formal document issued by a seller to a buyer to request payment for goods sold or services rendered.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 23, 2026

- Created by Docusign

Free Invoice Template in Docusign

Whether you are a freelancer finishing a project or a small business selling goods, Docusign offers a free invoice template that you can edit online to bill your clients professionally. This tool is perfect for creating and managing your payment requests in one secure place. Open the free invoice template in your Docusign account or with a Docusign trial.

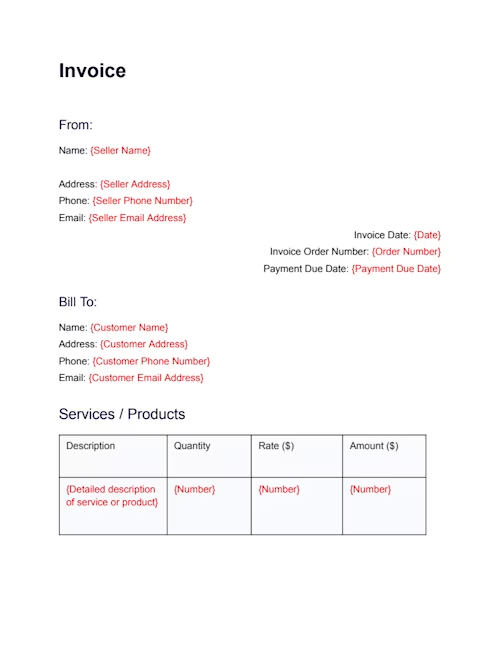

Our invoice template is free, customizable, and outlines all essential billing details such as a description of services, costs, taxes, and payment due dates. You can easily personalize the fields with your business information, add your logo, and adjust the terms to fit the specific transaction. This free invoice template simplifies your billing process, ensuring you include all the necessary information for prompt payment.

Once you have customized the template, you can share the document via a Docusign envelope to the client who needs to receive the bill. While not always required, this invoice includes signature fields for both the seller and the customer to formally acknowledge the transaction. After the invoice is finalized, you’ll be able to securely access the completed document in your Docusign account, and you can still download and print a hard copy for your records.

Overview of an invoice

An invoice is a critical commercial document that itemizes a transaction between a buyer and a seller. It serves as an official request for payment and provides a detailed record of the products provided or services rendered. More than just a bill, an invoice is a fundamental tool for accounting, helping businesses track sales, manage inventory, and monitor cash flow. For the customer, it provides a clear and itemized statement of what they are paying for. A clear, professional invoice builds trust and transparency, setting clear expectations for payment and helping to prevent future disputes. It is an essential component of maintaining accurate financial records for tax purposes and financial analysis.

Who is this invoice template for?

This invoice template is designed for a wide range of users in Canada who need a simple yet professional way to bill for their goods or services. It is particularly useful for:

Freelancers and independent contractors: Graphic designers, writers, consultants, and other self-employed professionals who need to bill clients for project-based work.

Small business owners: Entrepreneurs running retail shops, service-based businesses, or online stores who require a standardized document for every sale.

Service providers: Tradespeople such as plumbers, electricians, and landscapers who need to provide clients with a detailed breakdown of labour and material costs.

Consultants: Professionals who bill by the hour or by the project and need to provide clients with clear, itemized statements.

Anyone selling goods: Individuals or businesses that sell products and need to provide customers with a formal record of the purchase and the amount owed.

The purpose of an invoice

The primary purpose of an invoice is to request payment from a client after a transaction. However, it fulfills several other crucial functions that are vital for sound business operations. Using a standardized invoice template helps ensure all necessary details are included, which serves to:

Formalize a payment request: It officially notifies the customer that payment is due and provides all the necessary details to make that payment.

Create a legal record: An invoice serves as a legally recognized document that provides proof of a transaction. In the event of a payment dispute or audit, the invoice is the primary evidence of the agreed-upon terms and costs.

Facilitate accurate bookkeeping: Invoices are essential for accounting. They allow businesses to track revenue, monitor outstanding payments (accounts receivable), and manage cash flow effectively. In Canada, they are critical for tracking and remitting sales taxes like GST/HST and PST/QST.

Establish clear payment expectations: The invoice clearly states the total amount due, the payment deadline, accepted payment methods, and any penalties for late payments. This transparency helps prevent misunderstandings and encourages timely payment.

Maintain professionalism: Sending a clear, well-organized invoice reflects positively on your business. It demonstrates professionalism and helps build a relationship of trust with your clients.

Key clauses and components of the invoice template

Our free invoice template includes all the essential fields needed for a comprehensive and professional Canadian invoice. Using this invoice generator ensures you cover all your bases for clear and effective billing.

Key components include:

Seller and customer information: The template includes dedicated sections for the seller's name, address, and contact information, as well as the customer's billing details.

Invoice identifiers: Critical information for tracking, including a unique Invoice Order Number, the Invoice Date, and the Payment Due Date.

Itemized description of goods/services: A detailed table where you can list each service or product provided, along with the quantity, rate, and total amount for each line item. This ensures the client understands exactly what they are paying for.

Totals and taxes: The invoice automatically calculates the subtotal before taxes. It also includes separate lines for Canadian taxes like GST/HST and PST/QST, followed by the final total amount due in CAD.

Payment terms and methods: A section to specify accepted payment methods (e.g., credit card, bank transfer), provide a link for online payments, and list who to make cheques payable to.

Late payment penalties: An optional field to clearly state any interest or other charges that will be applied to overdue payments.

Contact for questions: A designated space to provide the name, phone number, and email of the person to contact for any questions or disputes regarding the invoice.

Signature fields: Optional signature and date lines for both the seller and the customer to formally acknowledge and approve the invoice.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates. The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement. Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Create a free account to start using this Docusign template now