Trends in Mortgage Profitability and Digital Innovation

Learn how to build a modern, digital mortgage and keep processes moving efficiently.

Table of contents

The mortgage industry today is at a critical inflection point, as record-breaking profits and transaction numbers begin to decline in response to shifting market conditions. Refinance mortgage demand is slowing and interest rates are projected to increase. At the same time, sales and fulfilment costs are causing loan production expenses to continue to grow.

Despite these headwinds, data from MBA.org indicates an improvement in closer productivity between 2019 and 2020.

“We see an upward trend in terms of retail loans closed per closer per month between 2019 and 2020 to about 51 loans per closer per month. The last time we saw numbers this high was in 2012. This could be due to many factors including COVID flexibilities and trends in productivity during the pandemic. It is an area to continue to watch - will these numbers stay high, or, begin to drop off?” observes Marina Walsh, Vice President, Vice President, Industry Analysis Research and Economics at the Mortgage Bankers Association.

Another reason for this increase in productivity could be that the onset of the pandemic forced many lenders to adopt digital tools and move towards hybrid closings– closings where some documents are executed digitally while others remain paper-based. The result is a more efficient process, with less errors, shorter closing ceremonies and satisfied borrowers.

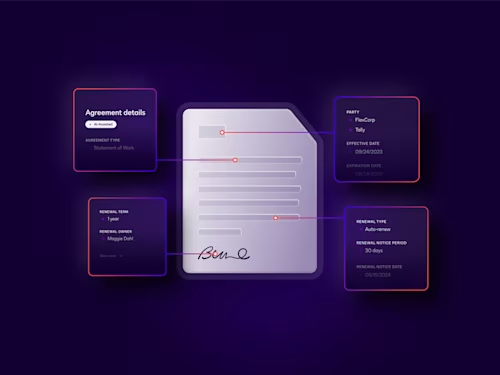

Digital mortgages with agreement technology

The Docusign Agreement Cloud for Mortgage supports lenders wherever they are in their digital journey, allowing them to build a modern mortgage and keep their processes moving efficiently. Solutions ranging from eSignature, to Notary and Rooms for Mortgage, coupled with pre-built integrations with leading loan origination systems that allow lenders to take a phased approach to building towards a fully digital closing experience.

As lenders look forward, they must examine how to evolve their mortgage processes to align costs with projected volumes. and the levers they should consider pulling to drive business success.

These are some of the challenges that industry and product experts discussed during a panel , featuring guest speaker Marina Walsh, Vice President Industry Analysis at the Mortgage Bankers Association along with Docusign product leaders, John Asermely and Andy Ambrose.

To learn more from their perspectives, register for the on-demand webinar, “Expert Panel: Trends in Mortgage Profitability & Digital Innovation.”

Related posts

Docusign IAM is the agreement platform your business needs